Senators seek higher tax on profits at hearing for bill to legalize sports wagering in Missouri

If the Missouri Senate debates a sports wagering bill that passed the House last month, it will likely include a higher tax rate and more money to combat problem gambling.

At the close of a hearing on the bill Wednesday, Senate Appropriations Committee Chairman Dan Hegeman didn’t specify what tax rate on sports wagering profits he would like to see. But he did say he wanted it to be higher than the 8% approved in the House, noting that the bill started with a 10% tax and legislation introduced in the Senate has set it as high as 21%.

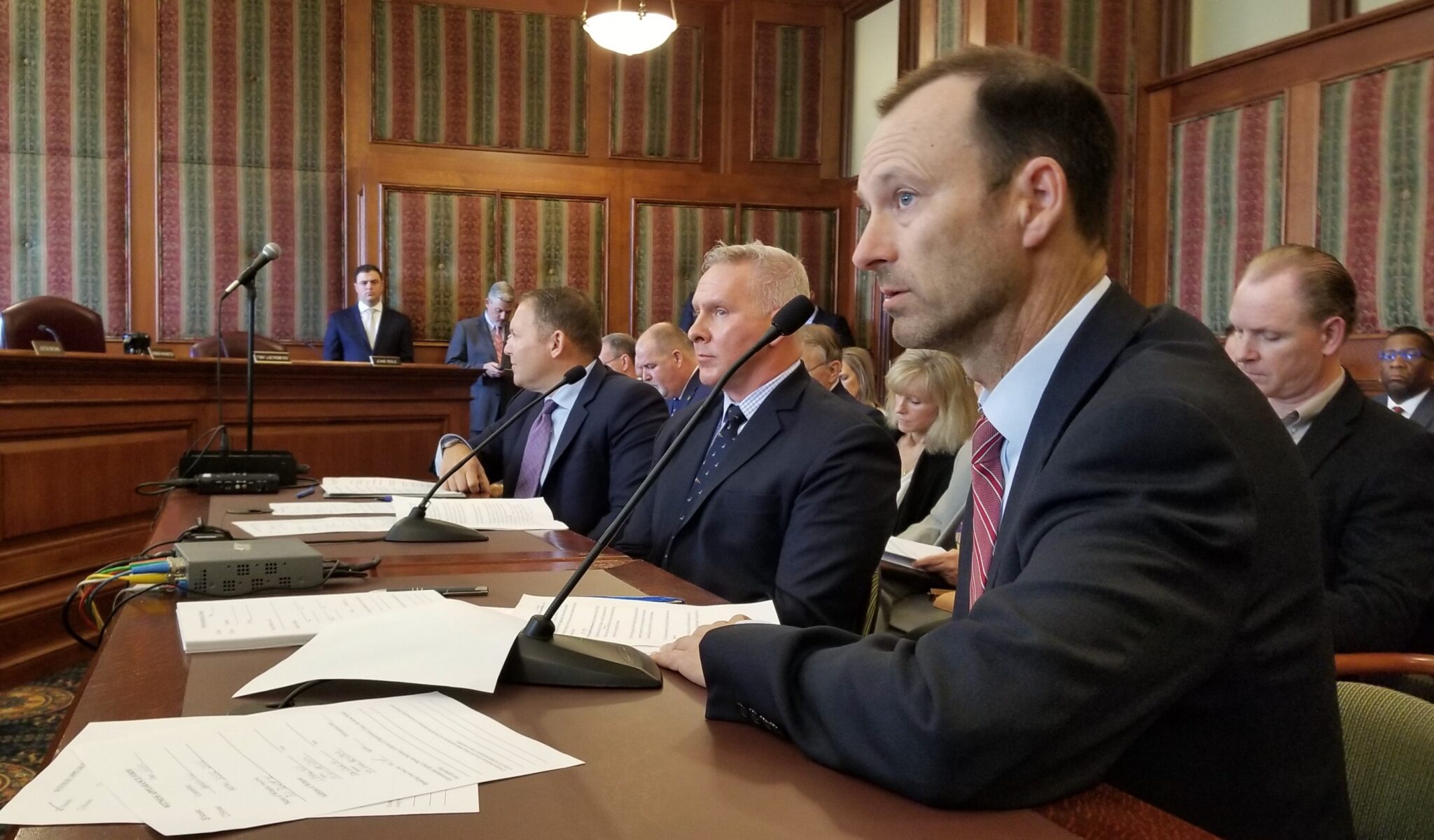

Others on the committee, as they questioned professional team executives and gambling lobbyists, also showed they are not satisfied with the House bill.

Sen. Denny Hoskins, R-Warrensburg, noted that in his version of the bill, with a 21% tax rate, revenues were estimated at $153 million annually. The estimate for the House bill, which includes deductions for promotional costs, is about $10 million annually.

Casinos currently pay a 21% tax on their net profits from wagers on slot machines and other games.

“In my bill, the state would get the difference,” Hoskins said. “In the House bill, the casinos would get the difference.”

Under the bill, drafted after negotiations between Missouri’s major professional sports franchises and the licensed casino companies, residents of the state could bet from their phones or computers on the outcome of games and performances of individual players.

Such betting is currently legal in the neighboring states of Arkansas, Illinois, Iowa, Nebraska and Tennessee. Only one, Iowa at 6.75%, has a lower tax rate than proposed in the Missouri bill.

“We need a fair tax rate that will produce revenue both for the industry and the state,” said Bill DeWitt III, president of the St. Louis Cardinals.

The question of the tax rate is a decision about who will receive the benefits of sports wagering, said Bob Priddy, the retired news editor of Missourinet who testified Wednesday to the committee. Priddy did not take a stand on the bill, saying he expects sports wagering to become legal at some point.

The casinos and the sports teams wrote the bill, he noted. Revenue from casinos currently supports budgets for cities where they are located, Missouri’s veterans nursing homes and education programs.

“None of them have any obligation to or responsibility for the people who sent you here,” Priddy said.

When voters ask after the session what lawmakers achieved, Priddy said, “are you going to say, stood up for teachers, veterans and home dock cities? Or are you going to say I voted to let you bet on sports.”

Backers of a bill to allow video lottery terminals in bars and fraternal clubs are opposing the House-passed bill, said lobbyist Andy Arnold, who represents J&J Ventures, one of the game vendors.

The video lottery bill is estimated to generate $250 million or more in new annual revenue.

In the House bill, Arnold said, revenue for the state “is sorely lacking and must be addressed.”

Arnold also noted that the constitutional provisions legalizing casino gambling requires all wagers to be made in a facility within 1,000 feet of the Missouri or Mississippi rivers. The bill requires the machines processing the bets to be located in those casinos but the gambler may be anywhere in the state.

“My clients would consider a challenge,” Arnold warned.

Sports wagering has been legal nationwide since 2018, when the U.S. Supreme Court struck down a federal law that limited it to Nevada. Nearly 30 states have legalized some form of gambling on sporting events.

As part of the expansion of gambling, the casino operators have tried to burnish their image for policing problem gambling. The bill sets aside $500,000 for the state fund that provides counseling and other support for problem gamblers.

State Rep. Dan Houx, R-Warrensburg, told the committee that the bill also promotes efforts to create awareness about problem gambling and the self-reporting system used by people who want to exclude themselves from access to casinos and wagering apps.

In addition, he said, casinos and vendors providing those apps would have to submit a plan for addressing problem gambling and studying the indicators that a bettor has a problem.

That may not be enough, Hoskins said, because the bill will make it possible for people to gamble through their smartphones, computers or smart televisions without leaving their homes.

Current funding for problem gambling is inadequate and the sports wagering bill does not do enough, Hoskins said, noting that some other states devote millions to the problem.

“All accounts say we are underfunded in our problem gambling fund at $250,000 without sports books,” Hoskins said.

Under the bill, each of Missouri’s six licensed casino operators would be able to offer three platforms, or “skins,” per casino, with each casino company capped at six total. Two casino companies, Penn National and Caesars Entertainment, each operate three casinos in the state.

Each of the six major sports teams that play their games within the state – the Cardinals, Kansas City Chiefs, Kansas City Royals, St. Louis Blues, St. Louis City soccer club and the Kansas City Current women’s professional soccer team – would also be able to operate a skin.

The teams would also have an exclusive zone around their stadiums where they would have a monopoly on marketing messages so they could promote their team-branded skins.

The recent reports that the Chiefs may consider relocating to Kansas led senators to question whether the team would be required to give up their skin if they left the state.

The report, from the NFL owners winter meeting in Florida, isn’t about a decision by the Chiefs, said Anne Scharf, director of civic affairs for the team. It is one idea being explored, she said.

In the committee, some lawmakers suggested the skins should be owned by the venue, like Arrowhead Stadium, instead of the team.

If a move is coming, Scharf said, it will not be soon.

The team is doing “an extensive survey to determine what is viable to renovate Arrowhead,” she said, noting the team has nine years left on its lease of the stadium that opened in the fall of 1972.

“We just want some commitment to Jackson County that we can keep you around,” said Sen. Barbara Anne Washington, D-Kansas City.

Miss Clipping Out Stories to Save for Later?

Click the Purchase Story button below to order a print of this story. We will print it for you on matte photo paper to keep forever.