Missouri tax cut special session delayed at least a week as negotiations continue

The legislature will not reconvene next week as previously planned to debate a $700 million tax cut proposal offered by Gov. Mike Parson, Senate Majority Leader Caleb Rowden said in an email to staff Wednesday.

Instead, the session is now scheduled to begin the following week, when lawmakers are already planning to be in town for the annual veto session.

The decision to delay the start of the session came after a meeting Wednesday between Senate and House leadership.

“It was a productive conversation and I certainly believe we have a path to provide meaningful tax relief to Missourians and continue to stand for our Missouri farmers,” Rowden said. “One point of agreement we came to was, given the nature of the scope of what we are doing here, giving more time for us to get it right was needed.”

The delay will allow the House and Senate to continue discussing the specifics of the tax cut and agriculture incentives package.

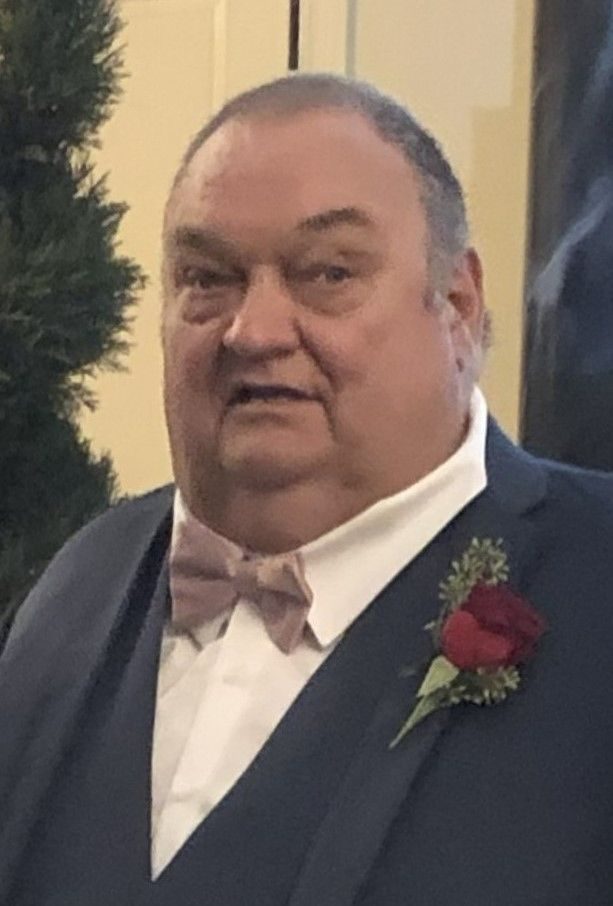

Parson pitched his proposal as a way to return some of the state’s record budget surplus to taxpayers and keep lawmakers from spending it on pet projects. His goal, he told reporters last week, was to offer a simple plan that could navigate through the legislative process in a short time period.

That timeline is now in jeopardy.

Proponents of the tax cut worry it could run into the same GOP infighting that has bedeviled the Missouri Senate for the better part of two years and ground most legislative progress to a halt. There has also been bad blood in recent years between the governor and House leadership that could become a stumbling block for Parson’s proposal.

In an effort to bring lawmakers into the discussion, Parson barnstormed the state speaking with Republican and Democratic legislators. He also asked GOP megadonor Rex Sinquefield, a longtime champion of tax cuts, to sit down with Republican leaders.

In 2014, over the objections of then-Gov. Jay Nixon, lawmakers passed an income tax cut intended to step the top rate down from 6% to 5.5%, with each step occurring when annual revenue growth exceeded $150 million.

Two other tax cut measures, in 2018 and 2021, made additional reductions in the top rate and increased the number of growth-triggered steps to seven. The rate this year is 5.3%, with five more reductions to come before the top rate settles at 4.8%.

Parson’s plan calls to replace those incremental cuts and set the rate at 4.8% now. He began talking about a permanent tax cut when he vetoed a plan for tax rebates that would be issued this fall. Lawmakers set aside $500 million to make payments of up to $500 for single taxpayers and $1,000 for married couples, with the rebates targeted to incomes of $150,000 and below.

Miss Clipping Out Stories to Save for Later?

Click the Purchase Story button below to order a print of this story. We will print it for you on matte photo paper to keep forever.