Illinois businesses brace for potential tax increase in Pritzker’s budget plan

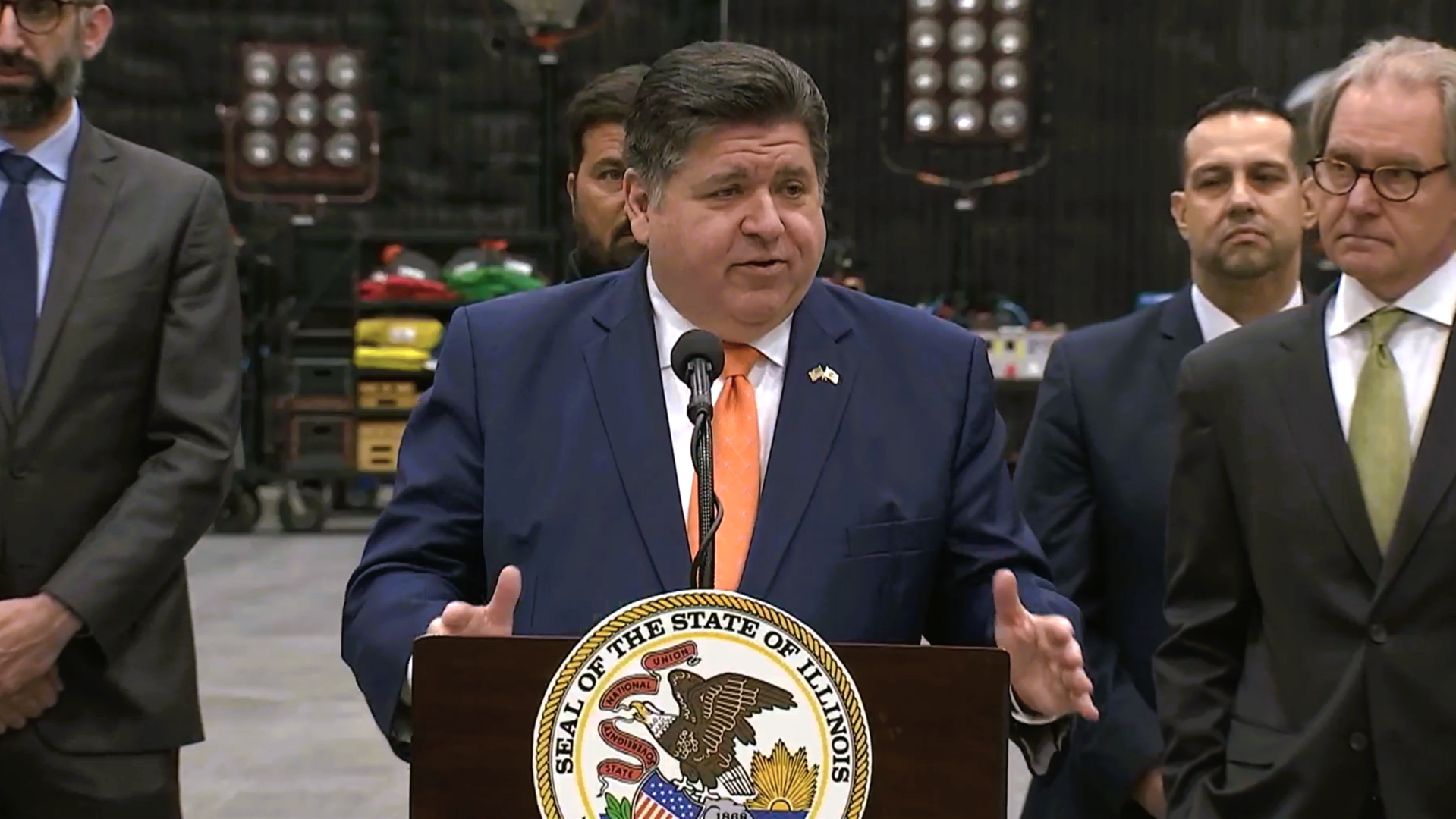

Illinois business owners are bracing for a potential tax hit from Gov. J.B. Pritzker.

The governor’s proposed budget extends the cap on business net operating losses, but increases the cap to $500,000. His office estimates the “revenue adjustment” will raise $526 million, the bulk of the nearly $900 million of tax increases in his $52.7 billion spending proposal.

Illinois Chamber of Commerce President and CEO Lou Sandoval said this would take funds from businesses to finance government.

“Whether you’re not calling it a tax [hike], in implementation it ends up being one,” Sandoval said. “It’s just a way of taxing businesses.”

Sandoval said big businesses are not the only ones that will suffer.

“They shouldn’t be penalized on their success. I think what ends up happening is that we look at companies and think we’re going after large corporations, but we’re actually impacting mid-cap and small businesses,” Sandoval said.

The cap on business losses might lead business owners to avoid making investments, he said.

“I think it would impact their propensity for risk. It also would impact their propensity for wanting to increase and grow their business footprint in the state of Illinois,” Sandoval said.

The fiscal year 2025 budget begins July 1. Legislators have until May 31 to approve the budget with simple majorities. They return to Springfield Tuesday.

Miss Clipping Out Stories to Save for Later?

Click the Purchase Story button below to order a print of this story. We will print it for you on matte photo paper to keep forever.