Moore says ‘Relief for Working Families’ package will eliminate many first-year fees for new businesses

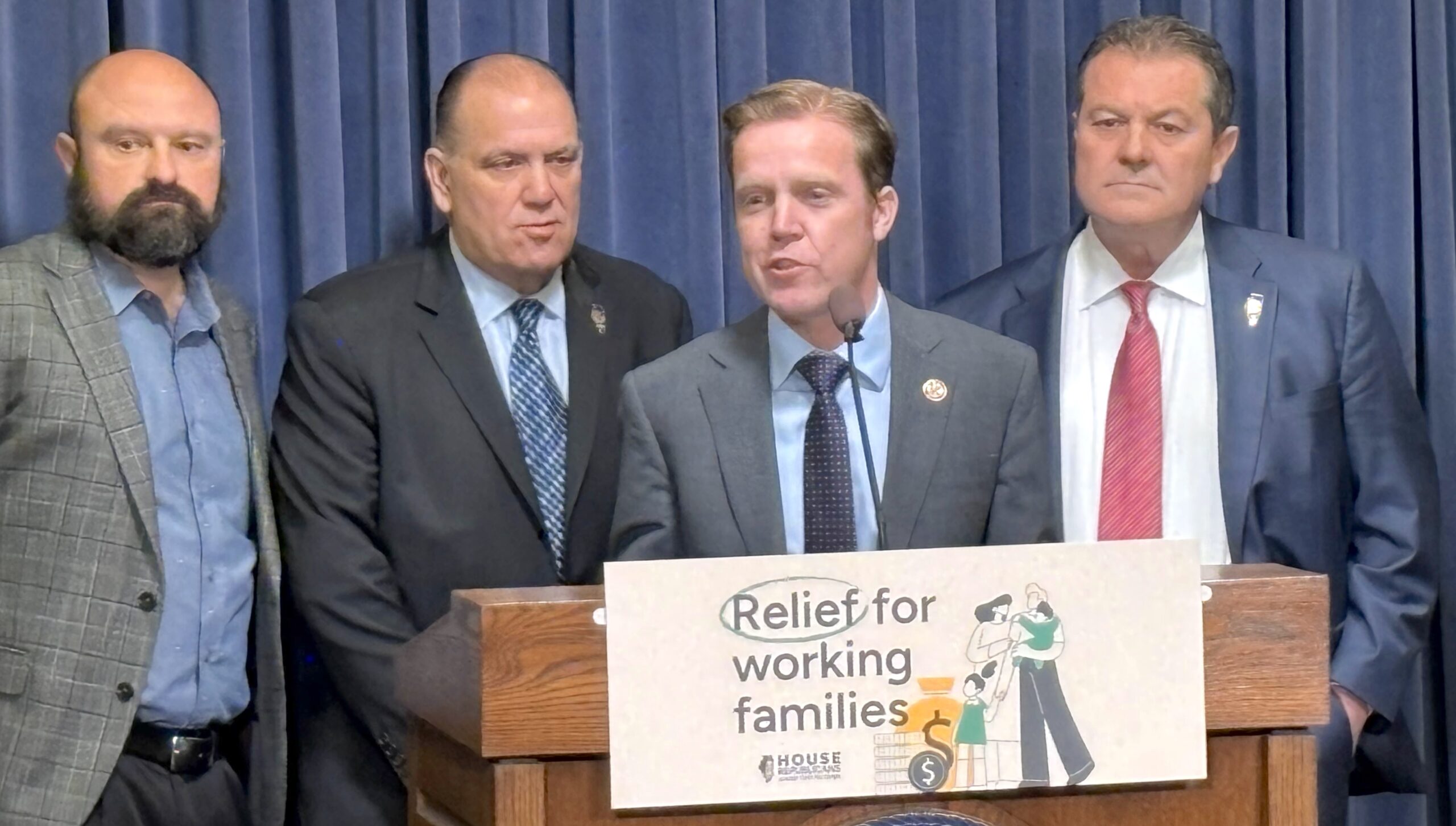

SPRINGFIELD, Ill. — State Rep. Kyle Moore and his House Republican colleagues recently unveiled a package of bills they will champion this spring to provide financial relief for Illinois’ working families.

“This package is called Relief for Working Families because that’s what it will provide, from furthering your education to starting a new business or simply keeping more of your hard-earned money in your own pocket. Working families need and deserve a break,” Moore said in a press release.

Included in the package is Moore’s Reducing Barriers to Start Act that will eliminate many of the first-year fees that new business startups face in Illinois, including all first-year business fees relating to licensing or registration.

“According to the U.S. Treasury, small businesses created more than 70 percent of net new jobs since 2019. Whether your dream is to start a business out of your home or to open a local restaurant that could create 20 new jobs, the Reducing Barriers to Start Act can help make that dream a reality,” Moore said.

Other elements of the House Republicans’ Relief for Working Families Plan are:

- Deducting state taxes on tips that are included in a worker’s federal adjusted gross income (HB1383).

- Doubling the maximum education expense tax credit from $750 to $1,500 (HB3821).

- Creating an income tax deduction for amounts paid by a worker’s employer as part of an educational assistance program (HB1752).

- Establishing the Illinois Trades Retention and Development Encouragement (TRADE) Grant Program for those seeking training in trades such as construction, electrical work and steel working (HB3807).

- Increasing trade training options by allowing a manufacturing, engineering, technology or trade (METT) teaching license to be awarded to experienced workers in those trades (HB1112).

- Awarding income tax credits to taxpayers who make contributions to organizations that award scholarships for technical education (HB1729).

“Together, these measures provide a great start to supporting working families and helping set them up for success,” Moore said.

Miss Clipping Out Stories to Save for Later?

Click the Purchase Story button below to order a print of this story. We will print it for you on matte photo paper to keep forever.