It’s Medicare’s Open Enrollment Period: Get local advice, don’t answer robocalls, and just beware

Each year Medicare has an open enrollment period for insurance that supplements Medicare coverage. It started October 15 and continues to December 7. Thank goodness this will be over soon … but then there’s next year!

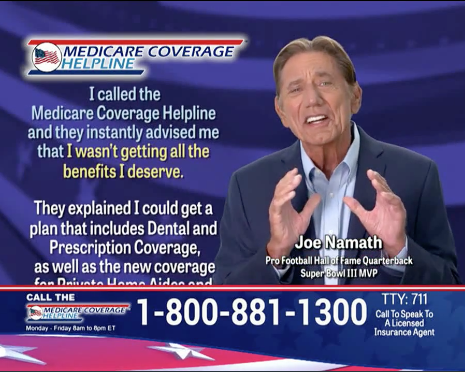

For those who are Medicare eligible, the enrollment period is open season for every scam and pressure tactic that can befall older folks. Mailboxes are jammed with solicitations. Robocalls are made every hour of the day. Emails are now common. And the TV ads! Does football legend Joe Namath really need to hawk Medicare plans? Insurance companies are persistent!

There may be circumstances when seniors might want or need to change coverage, but these are the exceptions. Instead, it’s a time when the unsuspecting, ill-informed, and often anxious senior, is made to think what they have isn’t what they need, or too expensive, or there’s a new product, or a product better for them, or they’ve been cheated out of something they are entitled to, or other often bogus reason to change coverage. The reality is that Medicare supplement plans are limited in choice and all must meet government prescribed requirements.

The Federal Trade Commission offers some tips to avoid marketing scams. The FTC points out that seniors have rights and agents must follow the law.

Some of the FTC’s marketing limitations cited are a joke in practice. One: “You should never get a phone call from a company you don’t have a relationship with.” One 95-year-old mentioned to me she had gotten as many as 17 calls in one day. Come on … she doesn’t have a relationship with that many companies! What’s heartbreaking is to learn too late they had been duped into falling for the tactics of the unscrupulous marketer.

The best advice:

- Reach out to a local agent you know and trust or who is recommended in the business. There are many in our communities. Get their advice. If problems arise, it’s helpful to have a local agent to call.

- Consider attending a program offered by a known and trusted organization to get independent advice on how to evaluate programs.

- Read over “Medicare & You,” an official publication provided each year by the Center for Medicare and Medicaid Services to all Medicare-eligible persons.

- If possible, have a family member or trusted friend be with you when you meet with an agent or consider your options.

- Don’t even answer the phone where the name or number is unknown. If it’s an important call, they can leave a message and you can call back. Take my word for it, you didn’t win the lottery, inherit from a person you never knew, and your grandkid isn’t stranded or in jail somewhere!

- Don’t provide any personal, banking, or similar information over the phone.

And just beware!

Jim Rapp has been practicing law for nearly 50 years and has published and speaks extensively on estate planning, business, education law, civil rights and other legal matters. He is a founding partner of Muddy River News LLC.

Miss Clipping Out Stories to Save for Later?

Click the Purchase Story button below to order a print of this story. We will print it for you on matte photo paper to keep forever.