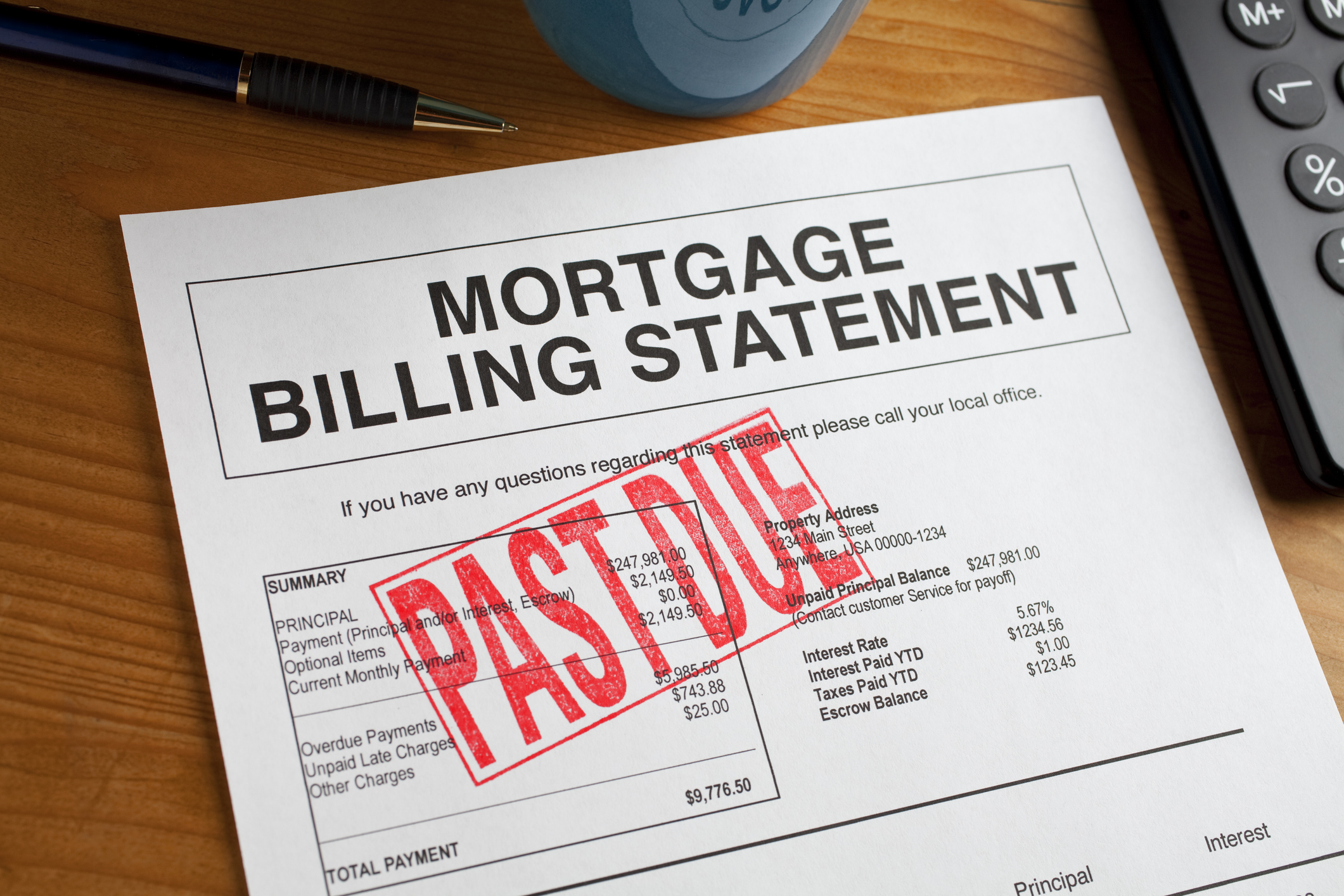

Illinoisans behind on mortgage payments

From THE CENTER SQUARE – A new study shows Illinois is leading the Midwest in delinquent mortgages.

Data from the Mortgage Bankers Association shows 5.7% of Illinois homeowners were at least 90 days behind on their payments at the end of 2020. The next closest was Indiana at 5.1%, Missouri was at 4.1% and Iowa and Wisconsin were both below 4%.

Illinois Policy Senior Research analyst Bryce Hill said it should come as no surprise, as Illinois was among the hardest hit by the pandemic and state-mandated lockdowns and high property taxes.

“Property taxes represent about seven additional mortgage payments for Illinois homeowners each year,” said Hill. “That eats into their mortgage equity and makes it more difficult to make these payments.”

Miss Clipping Out Stories to Save for Later?

Click the Purchase Story button below to order a print of this story. We will print it for you on matte photo paper to keep forever.