Hannibal School Board cuts tax rate

The Hannibal School Board set its tax rate during a public hearing on Wednesday evening. The total tax rate was set at $4.1244 for a total reduction of nearly six cents.

School District Business Manager Rich Stilley said the previous tax rate was set at $4.1814 per one hundred dollars evaluation. $1.07 of that was for debt service. The remaining $3.1114 is the incidental rate which funds the operations of the school district.

Assessed values in both Marion and Ralls Counties have changed, adding over $22 million to the school district’s valuation. With that increase, Stilley said when values go up, the state requires the tax rates to go down. The school administration proposed a tax rate of $3.0044 for the incidental fund and $1.12 for debt service.

Stilley said the increase in debt service is “vital.” He said the district needs to maintain its bonding capacity and cover its long term debt. A 100 percent collection rate of school district taxes would bring an additional $331,000. Stilley said the district typically sees between 94% and 95% in collections.

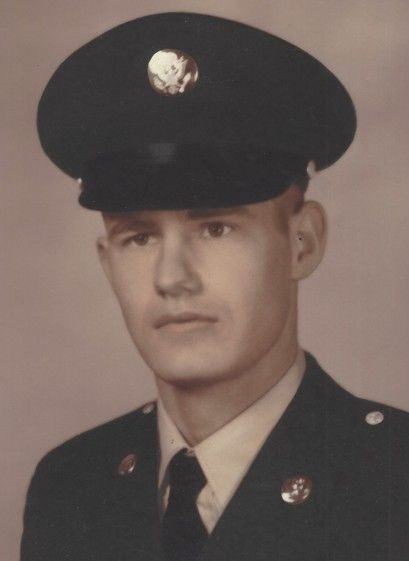

The board approved the new rate by a vote of 6 to 1 with Justin Parker casting the lone no vote.

Miss Clipping Out Stories to Save for Later?

Click the Purchase Story button below to order a print of this story. We will print it for you on matte photo paper to keep forever.