Scammers stealing information as new technology like AI helps them trick more people

Paying bills, scheduling appointments, applying for jobs – we share personal information with businesses and other people nearly every day.

Since so much of our data is shared online, it’s easy to forget that it’s valuable, especially to scammers. Nearly every scam involves some sort of identity or information theft.

Scammers want your personal information so they can steal money from you directly or impersonate you to carry out other scams. They seek out passwords, routing numbers, addresses, PINs, security codes on credit cards, birthdates, Social Security numbers and more.

To help you avoid identity theft, BBB’s International Investigations Initiative just released a new study. We found that over the past three years, identity theft reports to BBB increased.

What’s more, the way scammers steal information is changing as new technology like AI helps them trick more people, faster. Fraudsters who successfully steal personal information often sell it on the dark web to be used for future scams.

Information theft and data breaches are so common that it’s nearly impossible to keep all of your information completely safe. The good news is that there are red flags you can look out for and precautions you can take.

What are the signs of identity theft?

- Misspelled website URLs

- Suspicious links or attachments in unexpected emails

- Websites with low quality design

- Texts from unknown sources

- Unexpected messages on social media

How can I protect myself from identity theft?

- Secure your personal information. Usernames, passwords, bank accounts and Social Security numbers are just a few of the personal pieces of information you should be very wary about showing to anyone but fully trusted sources.

- Monitor your accounts. Information theft is incredibly hard to avoid. Regularly checking your credit report and financial accounts can help you catch fraud in the earliest stages before costly scams occur.

- Use strong passwords and multi-factor authentication. Experts agree that multi-factor authentication is one of the best ways to safeguard your accounts. While it may add a step when you log in, it can make your most sensitive accounts nearly impenetrable to all but the most cunning scammers.

- Protect your financial identity. If you don’t need to open any new credit accounts soon, freezing your credit can stop scammers from ever getting the chance to use stolen information. Setting up fraud alerts can help you cut off scammers’ attempts before any damage is done.

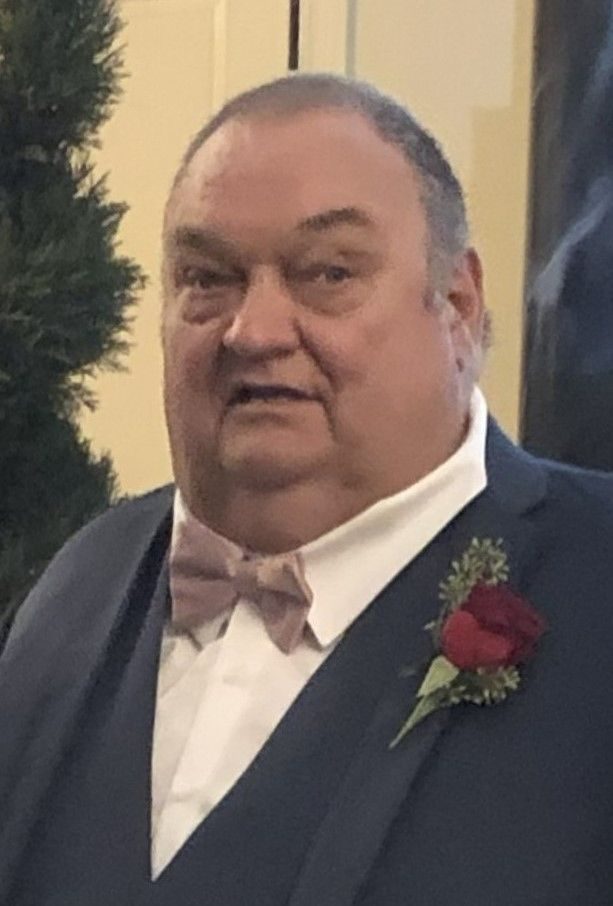

Don O’Brien is the regional director for the Quincy Better Business Bureau. Contact him at dobrien@quincybbb.orgor (217) 209-3972.

Miss Clipping Out Stories to Save for Later?

Click the Purchase Story button below to order a print of this story. We will print it for you on matte photo paper to keep forever.