Do you own Computershare account? Might be time to consider closing or updating it

Have a Computershare account? A good estate planning tip might be to either close the account or at least consider whether it should be updated.

Computershare is a super-large, Australian stock transfer company, providing global services as a transfer agent and holder of stocks. It provides many other financial services as well.

As an estate planning attorney, I seldom have seen large accounts with Computershare because of the wide availability of brokerage firms serving our communities. What I frequently see with Computershare are small holdings, often with a value of only a few hundred dollars or at most a couple of thousand dollars.

Not enough to be concerned about, one might think, but the accounts can be bothersome when an estate is being settled.

Do you have a Computershare account?

You might have a Computershare account but don’t give it much thought.

Many Computershare accounts were started for people who were policyholders of Prudential Insurance Company of America or Metropolitan Life Insurance Company. These companies were owned by policyholders but then “demutualized” and converted from a mutual life insurance company to a stock life insurance company. Policyholders ended up with their policies and some stock in the company.

Prudential became Prudential Financial, Inc. (trading symbol PRU) and Metropolitan became MetLife, Inc. (trading symbol MET). Rather than issue stock certificates, both companies opened accounts for its new shareholders with Computershare Inc.

Other companies have stock held by Computershare. AT&T is one. AT&T is not alone. Registration of shares with Computershare often follows when a company spins off or splits into several entities.

Because it is often a small holding, many people forget about the Computershare account. An annual or periodic statement is received but set aside and forgotten. If the account is small enough, a tax form isn’t even sent. Some dividend checks may be received, again, often small and hardly enough to pay for a dinner out. Lots of these checks aren’t even cashed and end up as unclaimed property. The Computershare account gets little attention.

Have you planned for the Computershare account?

Small Computershare accounts can be a hassle

Computershare accounts are often a hassle after death.

One of the key reasons for the hassle is that Computershare – even for small holdings – requires a Medallion Signature Guarantee. The guarantee is well intentioned because it confirms that the signature authorizing the sale or transfer of shares is genuine and that the signer has the legal capacity and authority to sign the transfer documents. There can be quite a stack of documents to complete and provide.

The trouble is that it’s very difficult locally to get a Medallion Signature Guarantee. Many banks, credit unions, brokers and financial firms don’t offer it at all. Those that do generally limit it to customers and, even then, customers may not get the guarantee unless they are within specific categories of customers. That’s understandable, because there are risks in providing the guarantee.

Yes, there sometimes are alternatives to a Medallion Signature Guarantee. However, only at an additional cost.

It is not worth the hassle.

Best advice may be to close or update the Computershare account

If you have a small Computershare account, the best advice might be to sell any shares and close the account after considering any taxes to be paid. Enjoy the proceeds. It’s a lot easier for you to do this than those who will inherit from you.

Other ideas could be to transfer the shares to a brokerage account, donate the shares, give them to family now, add a co-owner or designate transfer on death (TOD) beneficiaries. Even then, when there is a death, the Medallion Signature Guarantee may be required. Closing a small account usually makes the most sense.

What you don’t want to do is to let things linger, thinking it’s not worth being concerned about. It will be trouble for somebody down the road.

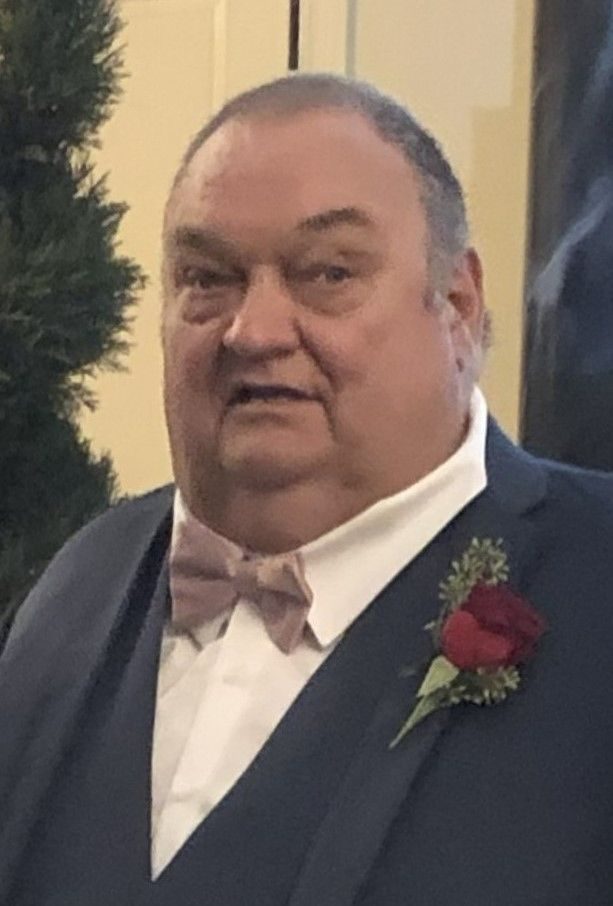

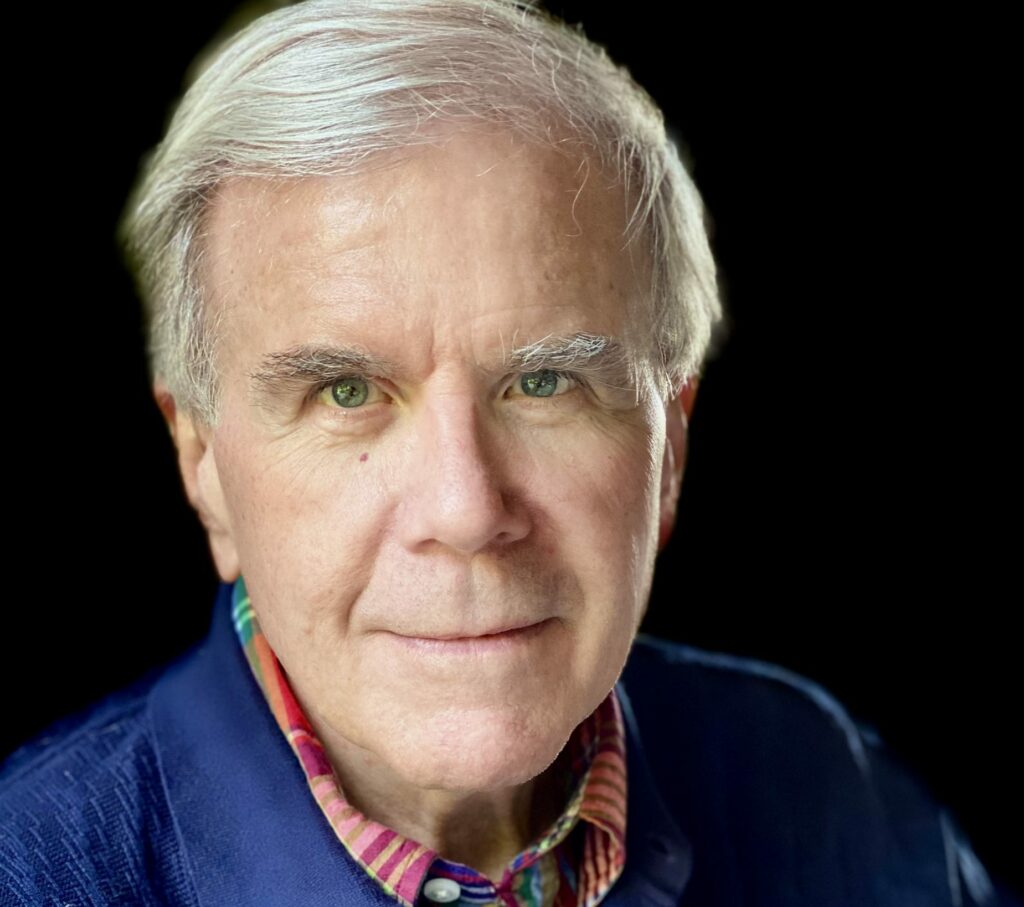

Jim Rapp is a practicing lawyer based in Quincy. He publishes and speaks extensively on estate planning, business, education law, and other legal matters. He is a founding partner of and contributor to Muddy River News LLC.

Miss Clipping Out Stories to Save for Later?

Click the Purchase Story button below to order a print of this story. We will print it for you on matte photo paper to keep forever.