Illinois 2022 budget: The state’s financial cliff will be waiting after the federal largesse runs out

By: Ted Dabrowski and John Klingner from WIREPOINTS

Illinois lawmakers have passed a budget for fiscal year 2022 that does nothing to improve the fiscal and economic trajectory of this state. Missing were the many spending reforms Illinois needs to bring down its pension debts and high property tax rates.

The budget reportedly spends $42.2 billion of $42.3 billion in expected revenues and relies on some $655 million in business tax hikes to make the budget “balance.”

Each year Illinois lawmakers find a new way to kick the can and this year billions in federal aid made that possible. The state’s tax revenues have boomed recently as a result of consumer spending spurred by stimulus checks, while the state government also received a direct $8.1 billion windfall from the federal government.

All that extra money – not to mention the $13 billion-plus that local governments will receive – has let lawmakers off the hook from making any tough decisions, allowing them to paper over Illinois’ many fiscal cracks that widened at the onset of the pandemic.

But the state’s financial cliff will be waiting after the federal largesse runs out. Here are the biggest takeaways from the 2022 budget:

1. The 2022 budget hikes taxes by $655 million. The budget adds $655 million in revenues by implementing several of Gov. Pritzker’s suggested tax hikes on businesses, what he calls“closing corporate tax loopholes.”

2. The budget spends $2.5 billion of the $8.1 billion in federal American Rescue Plan Act money. $1.5 billion will go toward violence prevention, business relief, and affordable housing. The other $1 billion will go toward infrastructure projects. Legislators say they’ll spend the summer months planning how to spend the remaining billions.

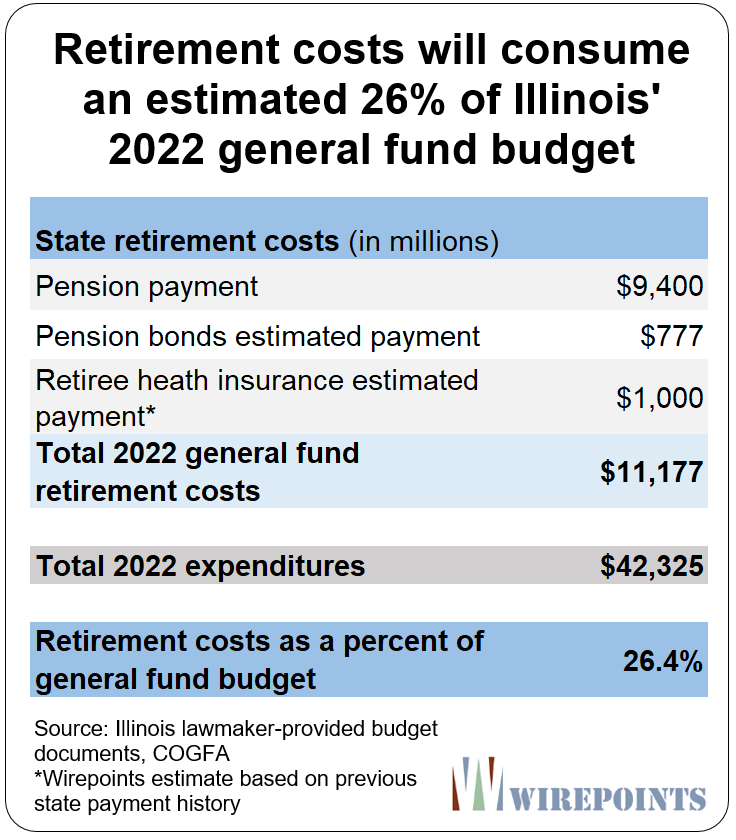

3. Official retirement costs will total over $11 billion in 2022.

Wirepoints calculates that retirement costs will consume 26 percent of the 2022 budget. The state is set to contribute $9.4 billion in General Funds to pensions, pay $777 million in pension bond costs, and pay an estimated $1 billion in retiree health costs.

In total, that’s $11.2 billion of the $42.3 billion budget consumed by retirement expenditures.

On top of the payments from the General Fund, another $1.2 billion in pension payments will come from other budget funds, meaning the state’s total retirement costs will be an estimated $12.4 billion in 2022.

4. Education spending increases by another $360 million

The budget adds another $360 million to K-12 education – part of the state’s decade-long goal to grow Illinois’ education budget as required by the 2017 “evidence-based” funding formula. In total, the state will spend $9.2 billion on education in 2022.

What lawmakers continue to ignore is how much Illinois already spends on education. The latest data from the U.S. Census bureau shows Illinois in total spent over $16,200 per student (including local, state and federal dollars) in 2019 – far more than any of its neighbors. Illinois spends 23 percent more than the national average ($13,187), 27 percent more than Michigan ($12,756), and 56 percent more than Indiana ($10,397).

Education policy needs to move from discussions on how much more money K-12 needs to how to better spend the money Illinois already has invested in education. That will be the focus of an upcoming Wirepoints report.

5. The budget pays off $2 billion in debt to the Federal Reserve

The 2022 budget will pay down the $2 billion remaining from the $3.2 billion the state originally borrowed from the Federal Reserve’s Municipal Liquidity Fund (MLF) program in the midst of the pandemic.

Lawmakers are taking credit for the move, saying paying down the debt early will save Illinoisans $100 million in interest savings. But no praise is warranted. Lawmakers are simply removing a cost Illinois should not have been saddled with in the first place.

Illinois was the only state to borrow from the MLF – largely due to lawmakers’ insistence on passing a 2021 budget that was $6 billion in the red. If lawmakers had simply passed a budget that was affordable to Illinoisans in the first place, none of the MLF borrowing or subsequent interest costs would have occurred.

6. No matter what politicians claim, the budget is not balanced.

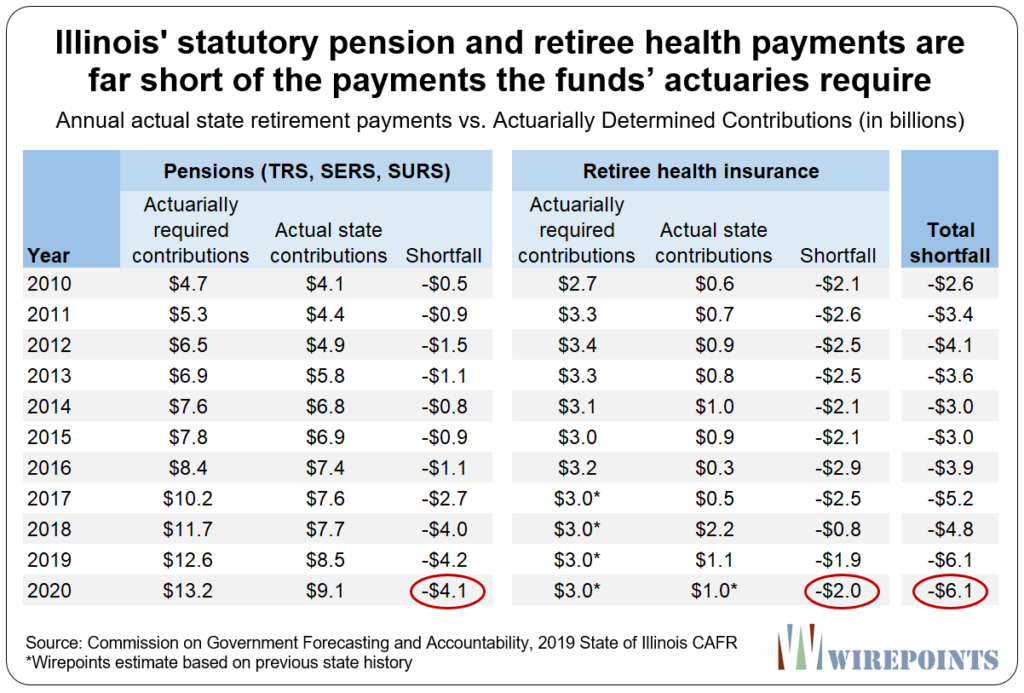

Lawmakers will claim the 2022 budget is balanced, but that’s just not true. Correct pension costs – based on the pension funds’ actuarial reports – would add another $4 billion in expenses to the budget, while retiree health insurance costs would add about $2 billion more. It’s this kind of failed accounting that’s led to the massive retirement debt build up over the past three decades.

We haven’t yet seen the precise shortfalls for 2022, but given no pension reform or change in the statutory payment requirements, the shortfall should be similar to amounts in recent years (see 2020 numbers below).

Miss Clipping Out Stories to Save for Later?

Click the Purchase Story button below to order a print of this story. We will print it for you on matte photo paper to keep forever.