Lawmakers measuring scope of damage, considering allocating federal funds

By JERRY NOWICKI

Capitol News Illinois

SPRINGFIELD – Since economic shutdowns began and COVID-19 death counts started to rise in March 2020, national unemployment rates have hovered at historically high numbers, stressing state unemployment systems left dealing with an unprecedented number of claims.

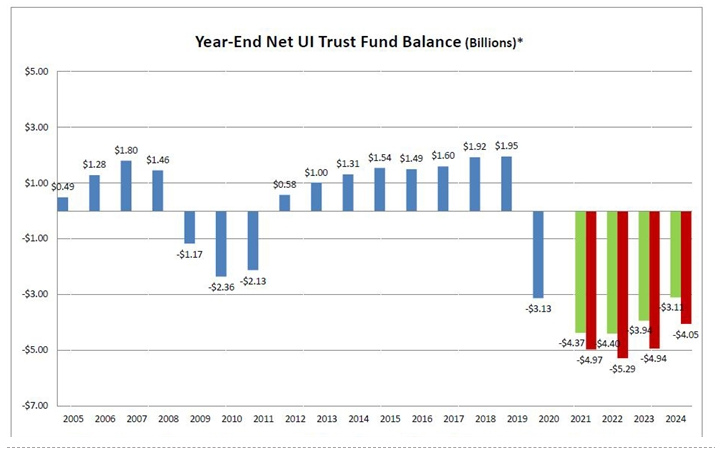

In Illinois, that’s led to a deficit in the Unemployment Insurance Trust Fund – or the pool of money used to sustain the social safety net – that could rise to $5 billion.

Stakeholders from both political parties, as well as business and labor groups, are now warning of “crippling” tax increases on businesses and cuts to unemployment benefits that could result if the ongoing deficit goes unaddressed for too long.

But even as the deficit continues to grow amid still-high unemployment rates, state lawmakers have not set a clear path forward for digging out of the historic hole.

“I think a larger discussion has to begin sooner rather than later, but we’re kind of waiting on, you know, getting a total handle on the size of the problem,” Rep. Jay Hoffman, a Swansea Democrat and assistant majority leader who is a lead House negotiator on unemployment insurance issues, said in a phone interview.

Meanwhile, the state also faces looming interest payments that are likely to cost tens of millions of dollars annually on more than $4 billion of federal borrowing undertaken to pay out benefits at the height of the pandemic.

Miss Clipping Out Stories to Save for Later?

Click the Purchase Story button below to order a print of this story. We will print it for you on matte photo paper to keep forever.