State general revenues top $50 billion for first time in FY 2022; pandemic-driven windfalls not expected to last long into current year

SPRINGFIELD — State tax revenues grew by $5.5 billion in the fiscal year that concluded on June 30, exceeding $50 billion for the first time in Illinois’ history, according to a new report from a state budgeting agency.

The 12 percent base revenue growth in Fiscal Year 2022 gave lawmakers near-unprecedented flexibility in the current budget year.

That allowed the General Assembly to approve $1.8 billion in tax relief, pay $500 million more to state pensions than statutes require, retire hundreds of millions of dollars in interest-accruing debts early, and drive the state’s “rainy day” fund to its highest-ever balance of over $1 billion.

It also helped the state reach a zero-day accounts payable cycle – meaning it was caught up on its bills – for the first time in decades.

But the report from the Commission on Government Forecasting and Accountability also noted that the pandemic-related drivers of growth, which led to nationwide revenue windfalls for nearly all state governments, are likely to wane in the coming months.

That’s something Gov. JB Pritzker told Capitol News Illinois last week that lawmakers planned for in April when they projected Fiscal Year 2023 revenues at $46.5 billion – an 8 percent decrease from the final FY 2022 numbers.

“We wrote that into the budget, that is a decrease in revenue just in this coming year,” Pritzker said in an interview. “So, we understand that there were some temporary nature of revenues that were coming in.”

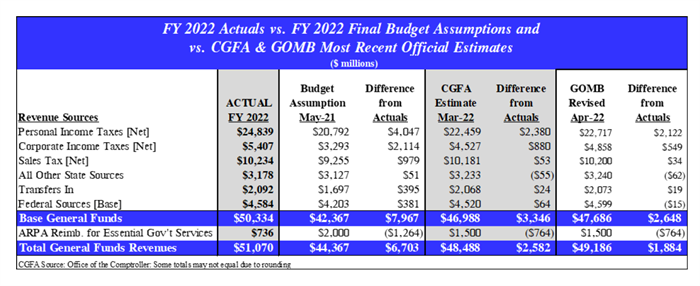

All told, the FY 2022 base revenues reached $50.3 billion without including direct federal aid. The number jumps to $51.1 billion when including a $736 million direct transfer-in of COVID-19 relief dollars.

The base revenues were nearly $8 billion beyond the May 2021 projections on which the FY 2022 budget was based. Personal and corporate income tax grew $6.1 billion beyond what was projected in May 2021, while sales tax revenues were about $979 million beyond projections.

While the revenue windfalls won’t alleviate longstanding budget pressures such as a $130 billion unfunded pension liability that demands about a quarter of state general revenue funds each year, it’s a level of good financial news that Illinoisans are not accustomed to hearing – and a level of progress Pritzker has hung his hat on as he seeks a second term.

“A significant surplus and a zero-day payment cycle mean that our schools are funded, our roads are being rebuilt, and our healthcare providers are paid on time – and Illinois taxpayers are no longer dealing with hundreds of millions of dollars in interest payments because government didn’t do its job,” Pritzker said in a statement last week. “Illinois’ massive bill backlog – eliminated since I came into office – once contained bills past due for as long as 500 days.”

The COGFA report noted that even though direct federal aid was not included in the base revenue calculation, the indirect effects of federal stimulus played a major role in the unexpected growth.

So major, in fact, that revenue came in beyond initial projections in 49 states in the fiscal year.

One driving factor, according to the report, was the “continuation of a pandemic-related shift” in consumer spending from non-taxed service-based sales to taxable goods, which created “strong market conditions” that led to increased tax revenues from corporate profits and capital gains.

Republicans have also attributed the revenue spikes at least partially to an “inflation-induced sugar high,” noting that as prices increase so does sales tax revenue.

“The influence of these particular factors is expected to wane as the state enters into FY 2023 resulting in reduced revenue expectations for the upcoming fiscal year,” the COGFA report noted.

Still, June’s receipts remained strong, growing by $736 million compared to the previous fiscal year.

As a result, final FY 2022 revenues were $2.6 billion higher than the April estimate from the Governor’s Office of Management and Budget that was used as the basis of this year’s budget negotiations.

A GOMB spokesperson said in an email Wednesday that the surplus has not led to any discussion of amending the FY 2023 budget in the first week of the new fiscal year. But it’s likely to allow for some flexibility.

“FY 2022 revenues continued to outperform expectations through the last quarter of the fiscal year,” GOMB spokesperson Carol Knowles said in an email. “This will allow the state to be better positioned in the coming year as we continue to monitor the national economic outlook.”

Knowles noted that the higher-than-expected revenues contributed to the improving fiscal situation which Comptroller Susana Mendoza and Pritzker highlighted in a pair of news releases last week.

Those releases noted Illinois has erased its “bill backlog,” ending the fiscal year with a general revenue funds payment cycle of zero days from when vouchers are received by the state comptroller’s office.

The $1.8 billion accounts payable balance was a far cry from the height of the state’s two-year budget impasse between Republican Gov. Bruce Rauner and Democrats in the General Assembly, when the bill backlog reached $16.7 billion.

Pritzker has also touted – and bond ratings agencies have noted – that Illinois focused much of its spending of surplus dollars on relieving interest-accruing debt. Illinois has seen six credit rating upgrades – two each from each of the three major agencies – in the past year.

In a news release last week Pritzker contrasted those upgrades with the eight downgrades the state received during the tenure of Rauner, whom Pritzker unseated in 2018.

While the upgrades this year mark the first upward break from a downward trend that began in the Blagojevich administration, Illinois remains in the worst shape of all states as judged by the ratings agencies.

And while Illinois lawmakers dedicated $1 billion to the rainy day fund, Mendoza said in a news release she’d push for laws mandating greater contributions to budget stabilization funds when Illinois has stronger-than-expected revenue performances in the future.

“The fact that we’ll have a billion dollars saved in our rainy day fund to help us during adverse downturns certainly helps, but Illinois must save more when we are able to with stronger-than-expected revenue receipts so that we strengthen our ability to weather through these unexpected crises,” she said.

Miss Clipping Out Stories to Save for Later?

Click the Purchase Story button below to order a print of this story. We will print it for you on matte photo paper to keep forever.