What’s in Pritzker’s proposed budget? A look inside the final spending plan of the governor’s first term

Each year in February, Illinois’ governor must propose to lawmakers a spending plan for the upcoming fiscal year. The General Assembly will then spend the next several months negotiating which proposals to include and which to scrap before sending the budget back to the governor for consideration.

On Wednesday, Gov. JB Pritzker delivered his fourth proposed budget, this one for fiscal year 2023 which will begin July 1, and outlined spending plans for an anticipated $1.7 billion surplus for the fiscal year that will end June 30.

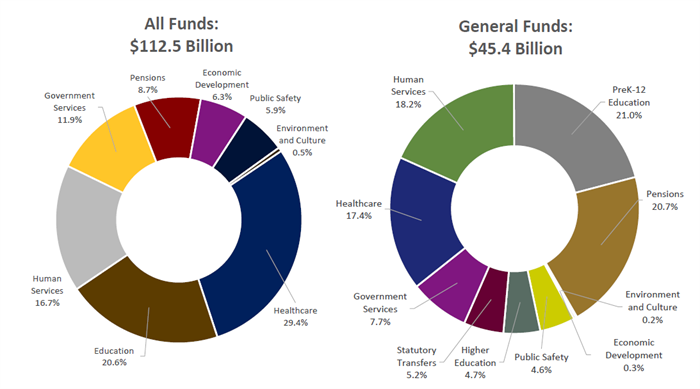

In the upcoming budget, the governor asks lawmakers to spend $45.4 billion from its general revenue funds, which are the main discretionary spending accounts for state lawmakers. Revenues are projected at $45.8 billion, with about $41.8 billion from state sources and the rest from the federal government.

The budget spends about $1.6 billion less than the one for the current fiscal year, based upon updated estimates from the governor’s office.

Below is a look at some of the major expenditures and new initiatives proposed by the governor.

Pension contributions

Illinois’ largest general revenue fund expenses continue to be K-12 education and pensions. The latter will make up 20.7 percent of the proposed general revenue spending in the upcoming budget, or about $9.6 billion.

The governor has proposed adding another $500 million to the pension payment beyond what is required by law in fiscal years 2022 and 2023.

That’s notable, because previous governors have been widely criticized for shortchanging the pension system – something Pritzker proposed, then quickly abandoned, in his first year in office. Critics often point out that the state law governing pension payments already shortchanges the system from what accountants suggest should be paid into it.

The governor proposed spending $300 million of the surplus from the current fiscal year to pay down pensions, with $200 million added to the statutory payment in the upcoming budget.

The governor’s office estimated the $500 million increase beyond statutory amounts would reduce unfunded liabilities – which sit at about $130 billion – by about $1.8 billion. A pension buyout program previously approved by the General Assembly has reduced that liability by about $1.4 billion, according to the governor’s office.

K-12 Education

Approximately 21 percent of the budget is dedicated to Pre-K-12 education, an increase of $498 million from one year ago.

That includes $350 million for the evidence-based funding formula for K-12 schools, which prioritizes new money toward the schools furthest from their “adequacy” target, which takes into account class sizes, a local district’s property values and other factors.

The budget asks for another $54.4 million to provide early childhood education services to another 7,100 children, and another $96 million in transportation and special education grants for schools.

Another $12 million would be added to the Regional Offices of Education budget to address truancy and chronic absenteeism, and agriculture education funding would increase by $2 million.

Temporary tax relief

The governor cited rising inflation as the basis for creating about $1 billion in temporary tax relief for motor fuel, groceries and property taxes.

The motor fuel tax relief would not lower gas prices, but it would prevent an annual increase to the motor fuel tax that is written into law from taking effect this year. It prevents a hike of 2.2 cents per gallon of gas, according to the governor’s office – a taxpayer savings it pegged at $135 million.

Motor fuel tax money does not go to the general revenue fund, but rather to road construction projects. The tax holiday does not appear to affect a proposed $46.5 billion capital infrastructure budget, which is mostly an extension of the 2019 Rebuild Illinois plan.

The governor also proposed rolling back a 1 percent state grocery tax for the fiscal year, a taxpayer savings pegged at $360 million. The state would reimburse local governments for the effect of the tax holiday.

Illinoisans currently eligible for a 5 percent property tax credit under current law – that is, joint filers earning below $500,000 and single filers earning below $250,000 – would be eligible for another 5 percent property tax credit under the proposal, up to $300. The taxpayer savings is estimated at $475 million.

Rainy day fund

Illinois’ “rainy day fund” at its height contained only about $300 million since its 2001 creation, but that was spent down to almost nothing during a budget impasse under Republican former Gov. Bruce Rauner and Democratic leaders in the General Assembly.

Pritzker’s budget proposes adding $600 million to the fund with a supplemental budget from the current fiscal year, while dedicating $279 million to the fund in FY2023 to bring the balance up to $879 million.

The governor also proposed dedicating $898 million to pay down overdue health insurance bills.

Higher education

The governor proposed spending $2.2 billion on higher education, a $208 million increase from the current year. That includes a $122 million increase to Monetary Award Program grants to help students demonstrating a financial need attend college.

Universities and community colleges would see their budgets increased 5 percent, or $68 million, while adult education programs would see $2.5 million in new funding and funding would increase for minority teacher scholarships by $2.3 million

Through College Illinois, a state-run prepaid tuition plan that is no longer open for enrollment, the state has about $230 million in obligations that the fund cannot currently meet. Pritzker proposed spending $230 million in general revenue funds to pay down that remaining balance, and his team estimated the long-run savings at about $75 million

Safety net

The beleaguered Department of Children and Family Services would see a funding increase of $250 million, or 16 percent, to about $1.3 billion from general revenue funds. That includes rate reforms for private sector providers in an effort to address staffing shortages, totaling $87.1 million.

The budget also provides $15.5 million to hire an additional 360 employees to address growing caseloads, improve caseload ratios and continue operations in licensing, monitoring and clinical services.

Funding for nursing homes would increase by $500 million, with lawmakers expected to take up rate reforms and a new provider assessment designed to maximize federal dollars, encourage improvement of care and staffing ratios.

Unemployment trust fund

As of Feb. 1, Illinois owed the federal government more than $4.5 billion for advances received to keep its unemployment insurance trust fund afloat during the height of the COVID-19 pandemic. By Sept. 30, Illinois will owe almost $32 million in interest on that borrowing.

If the state doesn’t take action to pay down the deficit, it could lead to massive unemployment insurance rate hikes on businesses and cuts to benefits for those claiming unemployment.

The budget does not include any money to pay down the borrowing, but the governor’s office said it remains in negotiations with lawmakers and representatives of labor and businesses on a solution. There’s serious consideration of using much of about $3.5 billion in remaining federal American Rescue Plan Act funding to pay down the deficit, according to the governor’s office.

Public safety

Pritzker noted his budget includes an $18.6 million increase to allow for three classes of Illinois State Police cadets. Another $5.4 million will go to opening a new forensic laboratory in Decatur in August.

The budget also includes $4.5 million to fund body cameras for ISP in accordance with a criminal justice reform bill passed one year ago, as well as providing the Illinois Law Enforcement Training and Standards Board with $10 million for distributing grants to local law enforcement for body cameras.

The Department of Human Services budget includes $240 million as part of a two-year, $250 million commitment to the Reimagine Public Safety Act, which aims at investing violence prevention resources in some of the state’s most dangerous areas. Just $5 million of that comes from the general revenue fund, with $235 million funded through the American Rescue Plan Act.

Revenues

The budget does not call for raising taxes to create any new revenues.

The state does expect a 4 percent increase in income tax receipts at $22.4 billion. Corporate income taxes are expected to decline 5.4 percent to $4.4 billion, with sales tax decreasing 1.3 percent to $9.9 billion and other sources netting $3.1 billion.

The lottery is expected to bring in $754 million, legalized gambling $157 million, and adult-use marijuana $142 million. Federal sources account for just over $4 billion.

Miss Clipping Out Stories to Save for Later?

Click the Purchase Story button below to order a print of this story. We will print it for you on matte photo paper to keep forever.