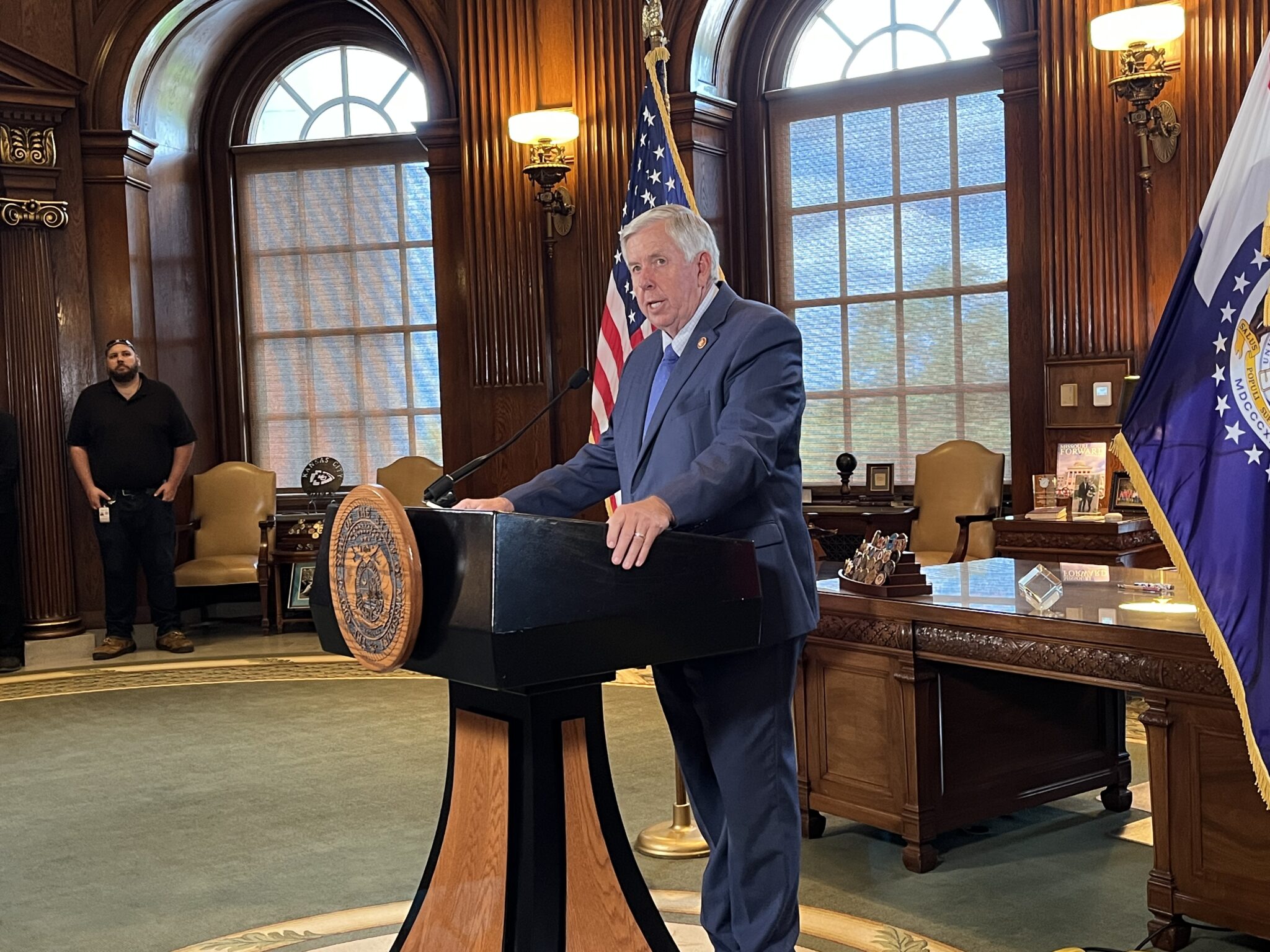

Missouri governor calls special session after Labor Day on $700 million income tax cut

Gov. Mike Parson announced Monday that state lawmakers will be returning to the Missouri Capitol after the Labor Day weekend to weigh passing a $700 million income tax cut and slate of agricultural tax incentives.

Parson’s proposal would lower the state’s top income tax rate from 5.3% to 4.8% and eliminate the bottom income tax bracket so Missourians wouldn’t have to be taxed on the first $1,000 of current taxable income. The standard deduction for individuals would be increased by $2,000 and by $4,000 for married joint filers.

“Combined, these tax cut proposals would mean that Missourians would earn their first 16,000 (dollars) tax-free,” Parson said during a press conference from the state Capitol.

Lawmakers are set to reconvene in Jefferson City at noon on Sept. 6 — a little over a week before the annual veto session begins Sept. 14. Parson said he would like the special session to end quickly, and expressed hope a bill containing his proposal could clear the Senate and be sent to the House by veto session.

Parson first announced his intention to call a special session in July, after he vetoed a tax rebate plan and slate of agricultural tax credits. Vetoing the agricultural tax credits bill was not something he took lightly, Parson said, but the bill passed last session “was a bad deal” and “special interests were involved in a bill they had no business being involved with.”

Lawmakers will once again consider the package of agricultural incentives that would benefit meat processing, biodiesel products, urban farming, family farms and others. Rather than having the credits expire in two years, Parson is calling for them to be renewed for at least six.

“As a farmer myself, the price of diesel has almost tripled. Fertilizer prices have skyrocketed, and it seems operation costs are ever increasing,” Parson said. “This coupled with inflation at a record high means we cannot leave our farmers, ranchers and business owners with a bad deal.”

In a joint statement, House Speaker Rob Vescovo, R-Arnold, and House Majority Floor Leader Dean Plocher, R-Des Peres, said the House made tax relief and support for the agriculture industry its top priorities this past legislative session.

“We stand ready to again work on these issues to help Missouri families in these challenging times,” the statement read.

The Missouri Agribusiness Association, Missouri Cattlemen’s Association, Missouri Corn Growers Association, Missouri Farm Bureau Federation, Missouri Forest Products Association, Missouri Pork Association and Missouri Soybean Association, said in a joint statement that the groups support Parson’s call for extending agricultural tax credits for at least six years, “to continue making smart investments today that will pay dividends and build this state’s economic base for decades to come.”

Parson said he plans to combine the two proposals into one bill in order to keep the process as simple as possible. Lawmakers to sponsor the bill in the Senate and House have not yet been determined, he said Monday.

The special session comes as the state has nearly $4.9 billion in general revenue — more funds on hand than ever before.

However, some Democratic lawmakers and advocates have expressed concern that an income tax cut is poorly-timed, with one-time federal funds contributing to the state’s rosy financial situation that may not last long-term.

House Minority Leader Crystal Quade, D-Springfield, called the proposal “a textbook example of fiscal irresponsibility.”

“A cardinal rule of responsible budgeting is don’t use temporary revenue to take on permanent expenses,” Quade said in a statement. “Yet the governor’s plan uses a temporary budget surplus as cover for a permanent loss of revenue that will put Missouri government back into the financial hole it just climbed out of.”

Amy Blouin, the president and CEO of the liberal think tank Missouri Budget Project, echoed Quade’s comments in a statement after Parson’s announcement, warning the plan would ultimately lead to cuts to state services like in neighboring Kansas. What’s more, Blouin said the proposal will primarily benefit the wealthiest Missourians, and not the thousands who earn too little to owe income taxes.

“In fact, in Missouri, the lower your earnings, the more you pay in state and local taxes as a share of what you make: according to the most recent analysis, Missouri families in the bottom quintile of income pay 9.9% of their income in state and local taxes, compared to just 6.2% for the wealthiest 1% of families,” Blouin said.

Parson stressed his office has analyzed what’s feasible and can be maintained with general revenue, rather than federal funds, and that he believes the state can handle the costs.

“If this goes well and if the economy goes well,” Parson said, “then I think you can be right back to the board doing more for the people of Missouri. If we can afford it, we can keep the economy going.”

Looming over the upcoming special session is deep tensions in the Senate. Although the conservative caucus disbanded earlier this month and called for unity among the Republican supermajority, the special session will be lawmakers’ first test on whether that holds true after a contentious primary election.

“I think the Senate truly has an opportunity to come together on both sides of the aisle,” Parson said, “to understand this is good for all Missourians, no matter where they’re at.”

Another factor is that the Missouri House is currently undergoing renovations, with desks and chairs removed while new carpet is being installed. The House electronic voting machine is also being replaced. Parson said he was told renovations would be finished by the end of August.

With recent special sessions mired in dysfunction and failing to accomplish all his priorities, Parson held meetings with legislators throughout the state in the lead up to Monday’s announcement. He also plans to embark on a series of visits across the state this week to promote the income tax cuts and agricultural credits.

He’s tapped Rex Sinquefield, a retired St. Louis investor and the state’s most prolific political donor, to meet with legislators. During those meetings, Sinquefield has brought along conservative economist Art Laffer, who is credited as the architect of the controversial tax cut package in Kansas that was ultimately repealed after years of budget shortfalls.

Parson said Thursday his office has talked to many organizations and think tanks on both sides of the aisle, including weighing the pros and cons of Kansas’ experience. There’s some conservative groups that would likely want to see the state go even further, Parson said.

“I think you got to have a balance in this state to understand how important the income tax structure is to this state and how much dependency we have on it,” Parson said. “So you just can’t go out there and tip that scale too much.”

Miss Clipping Out Stories to Save for Later?

Click the Purchase Story button below to order a print of this story. We will print it for you on matte photo paper to keep forever.