Everything you need to know about the latest HBPW electricity rate hike — and why it’s unlikely to be the last

HANNIBAL, Mo. — The Hannibal Board of Public Works (HBPW) shared plans for a 12.2 percent rate increase for electrical services in the upcoming fiscal year at an administrative hearing before the Hannibal City Council last week.

The increase was included in the organization’s budget for fiscal year (FY) 2026, which was unanimously approved by the HBPW Board of Directors at its Apr. 21 meeting. A public rate hearing will be held, likely in mid-September, to allow residents to ask questions and voice concerns about the increase ahead of the board’s final vote.

If approved, the increase will take effect Oct. 1 — exactly one year after the 2024 rate increase of 9 percent and two years after the 2023 increase of 9.25 percent. That translates to an additional $20 per month on average, as noted by 3rd Ward Council Member Bob Koehn during the hearing.

“Isn’t very much for the majority of people in Hannibal, but there are some people in Hannibal with a fixed income,” he said. “That would be a very big impact.”

HBPW Financial Director Paul Trenhaile encouraged residents struggling to pay their utility bills to contact the customer solutions department to get connected with local aid organizations. Dozens of other cost-saving suggestions for every budget are listed on their website.

The HBPW doesn’t receive taxpayer funding from the city, but the city receives a percentage of HPBW’s annual revenues as required by the city’s charter. According to the board’s most recent annual audit, the board transferred nearly $2 million into the city’s general fund last year. Their electric department maintains more than 1,700 streetlights, six substations and 120 miles of electric lines throughout the city.

HBPW board meetings are held at 4 p.m. on the third Monday of each month in the HBPW Conference Center on Industrial Loop Drive. Though they’re open to the public, recent meeting minutes indicate low citizen turnout — if any show up at all.

“We have held (HBPW meetings) in the evenings, we’ve held them in the mornings, we’ve held them at different times, and unless you use the words ‘rate increase,’ people don’t show. People don’t come,” HPBW general manager Darrin Gordon said at an April 1 Hannibal City Council meeting.

Following the hearing, social media comments from citizens pointed to greed and prodigal spending by the HBPW as the hidden drivers of yet another increase. While that would certainly be a more straightforward explanation, the reality is complex, and a range of factors at multiple levels have contributed to the current situation.

A grossly oversimplified explanation for the increase is that the state of the HBPW’s cash reserves isn’t looking great, but corporate greed and reckless spending would actually be one of the best-case scenarios. If that were the case, it would imply that the City of Hannibal — its citizens via boycott power, its councilmembers via impeachment power or even its HBPW board members and employees via reorganization and rehiring efforts — had any control over the matter.

Instead, the state of their reserves can be attributed to three main issues that don’t particularly play well together: skyrocketing capacity costs, fractured market dynamics and previous efforts to shield customers from rate hikes.

‘Electrical insurance’ costs increased by more than 6,000% since 2021

Erica Mitchell, HBPW community relations coordinator, said the term “capacity” is used to describe insurance against electricity shortages on the grid, for which HBPW paid less than $50,000 in FY 2021.

“We went from something that we didn’t even budget for … to paying $11.6 million in four years,” Trenhaile said during the hearing.

Capacity costs have catapulted in four years from $45,000 to $2.9 million per year on average, marking a catastrophic 6,345 percent cost increase. But why did it increase in the first place? And why was the change so severe?

Rapid post-pandemic market rebounds and increasingly frequent and severe extreme weather led to explosions in demand across the country at the same time supply was shrinking, leaving the grid in an increasingly fragile state due to inflation-related operating cost increases, global supply chain issues and the accelerated retirement of coal plants.

Its vulnerability culminated in February 2021 with the arrival of Winter Storm Uri, which left more than 4.5 million Texans without power in below-freezing temperatures. As many as 750 lives were lost and upwards of $300 billion in damages occurred as a result, marking it as one of the costliest disasters in U.S. history.

The manifestation of market and weather induced worst-case scenarios, coupled with the grid’s aging coal plant infrastructure that’s significantly more expensive to maintain and far more failure-prone, resulted in bolstered requirements to ensure communities were equipped with electrical safety nets should they ever need them — while simultaneously delivering a gut punch to the financial stability of their utility providers.

Missouri is in an especially tricky spot with capacity rates due to its difficulty in fulfilling its covenant requirements with the Midcontinent Independent System Operator (MISO), the organization that essentially moves all of the electricity to where it needs to go in the region and ensures the reliability of the grid in its territory, which includes much of the central U.S. and parts of Canada.

Areas of the region with more supply get lower capacity rates, while areas with less supply essentially get hit with penalty fines. MISO’s capacity rates for its zones ranged between $15 and $91/MW-day in the fall and spring — but Missouri’s was a whopping $719.81/MW-day.

New summer rates, announced at the end of April following MISO’s latest capacity auction, will bring some relief to the Show-Me State but are sure to disrupt neighboring zones with a rate of $666.50/MW-day — 22 times higher than the $30/MW-day summer rate last year.

Trenhaile said the board did “significant hedging” for the upcoming year, meaning they got ahead of unpredictable cost swings by locking in a fixed capacity rate ahead of time. The board will pay $1.33 million in capacity throughout FY 2026. Without hedging, the figure would’ve been around $2.77 million.

AI data centers anticipated to double demand, consume 20 percent of all electricity by 2030

As if extreme weather, unreliable infrastructure and market sneak-attacks didn’t put enough stress on the grid, a new era of dependence has begun with the explosion of the energy sector’s ultimate frenemy: AI.

Electricity usage had been increasing in the years leading to AI’s arrival, such as the rapid industry growth of heat pumps and electric vehicles by 2022 and an increase in the amount of household electronics and the frequency of their use across the board.

To put the impacts of more gradual weather changes into perspective, the number of U.S. households with air conditioning increased by nearly 20 percent between 2005 and 2020, according to data from the U.S. Energy Information Administration. In the Midwest specifically, the figure had increased by roughly 50 to 60 percent.

AI is playing a different ballgame, though — 24 hours per day, seven days per week, with each data center using as much electricity as 100,000 homes at any given time and future models anticipated to consume 20 times as much. When taken together, current AI data centers are estimated to use the same levels of electricity as the entire airline industry, and a report from the International Energy Agency projects they could demand up to 20 percent of the world’s energy supply by 2030.

Its energy demands are more than likely to stunt its own growth; tech research firm Gartner says “40 percent of existing AI data centers will be operationally constrained” by power shortages as soon as 2027.

All of this arrives at a time when coal-powered energy’s fall from dominance is well underway. More than half of the coal-generating capacity in the U.S. will be gone by the end of 2026, just 15 years after it peaked in 2011, according to the Institute for Energy Economics and Financial Analysis.

The HBPW entered into a contract in 2007 with Prairie State Energy, a coal plant in southwest Illinois that was anticipated to be a state-of-the-art, eco-friendly approach to coal-powered energy that would secure a steady and reliable supply of “clean” energy for decades.

Instead, it became the top polluter in the state of Illinois and the 12th in the country. Its construction ran $1 billion over budget, its prices have been above those of the market since it opened in 2012, and the entire coal industry lost its luster in the American sector faster than anyone anticipated in the years following the signing of the agreement. What was supposed to be a solid investment turned into an inescapable, long-term commitment.

The HBPW’s relationship with the plant has evolved a bit since then, but it — and more than 200 other communities across several states — are locked in to the end of the plant’s life. Though it’s still young in comparison to its counterparts, the Illinois Climate and Equitable Jobs Act of 2021 mandates that it must get its carbon emissions in check or close early in 2045.

Coal everywhere is becoming more expensive to produce for manufacturers, partially due to hefty fines imposed by the EPA aimed at protecting human and environmental health. Furthermore, their old age has garnered untenable maintenance costs to resume operational capacity as needed, making them less reliable and less cost-efficient for consumers. A 2021 study found eight in 10 existing coal plants at the time were either less cost-efficient than nearby wind or solar plants or were retiring due to old age.

Coal has its issues, but so do the more economically and environmentally friendly alternatives of wind and solar power when the wind isn’t blowing and the sun isn’t shining — another supply-related factor adding strain to the grid.

The equipment supply chain also has led to significant increases for the HBPW. Mitchell said the same transformer bought for $488,000 in 2017 for a south side substation had risen by almost $1 million seven years later when another one was needed for the Indian Mounds substation. She said prices for other relevant equipment, like meters and smaller residential-sized transformers, also have increased. That largely hasn’t reflected the likely impacts from new tariffs, which could apply to as much as 80 percent of the industry’s transmission and distribution equipment.

More increases likely to come

As unpleasant as another rate hike may be, it’s hardly a surprise.

After all, when the HBPW recommended a 15 percent increase in September 2024 but ultimately voted to implement a smaller increase of 9 percent instead, board member Kellie Cookson warned her peers that an additional increase could be needed by early 2025, despite proposing the smaller increase herself.

Former board member and current Hannibal Mayor Darrell McCoy joined Cookson in voting in favor of the small increase, while members John Ortwerth and Bill Fisher voted against it because it would lead to an additional increase later. Former Mayor Barry Louderman broke the tie vote in favor of the 9 percent increase.

Now another hike is on the table.

A healthy build-up of reserves allowed the HBPW to delay passing cost increases to their consumers temporarily, but the rate of industry increases across the board would be unsustainable for any reserve fund to fork over, regardless of its health or the fiscal responsibility and expertise of those managing it.

The rate hikes implemented in 2023 and 2024 have allowed the board to collect $3.68 million in new revenue. The proposed 12.2 percent increase is expected to generate more than $3 million in new revenue over 12 months.

McCoy said during Tuesday’s hearing that one of the HBPW’s budget line items had not been updated to reflect savings of $661,000 related to recent switches in insurance policies. Mitchell confirmed to Muddy River News on Friday morning that the specific budgetary item McCoy identified had been reviewed further.

“Our budgeted amount of $800,000 for fringe benefits in the Electric Fund was an estimate and had not been updated after the switch to the new insurance carrier was finalized,” she said in an email. “We expect our actual cost for fringe benefits in the Electric Fund to be closer to $538,000 for FY26.”

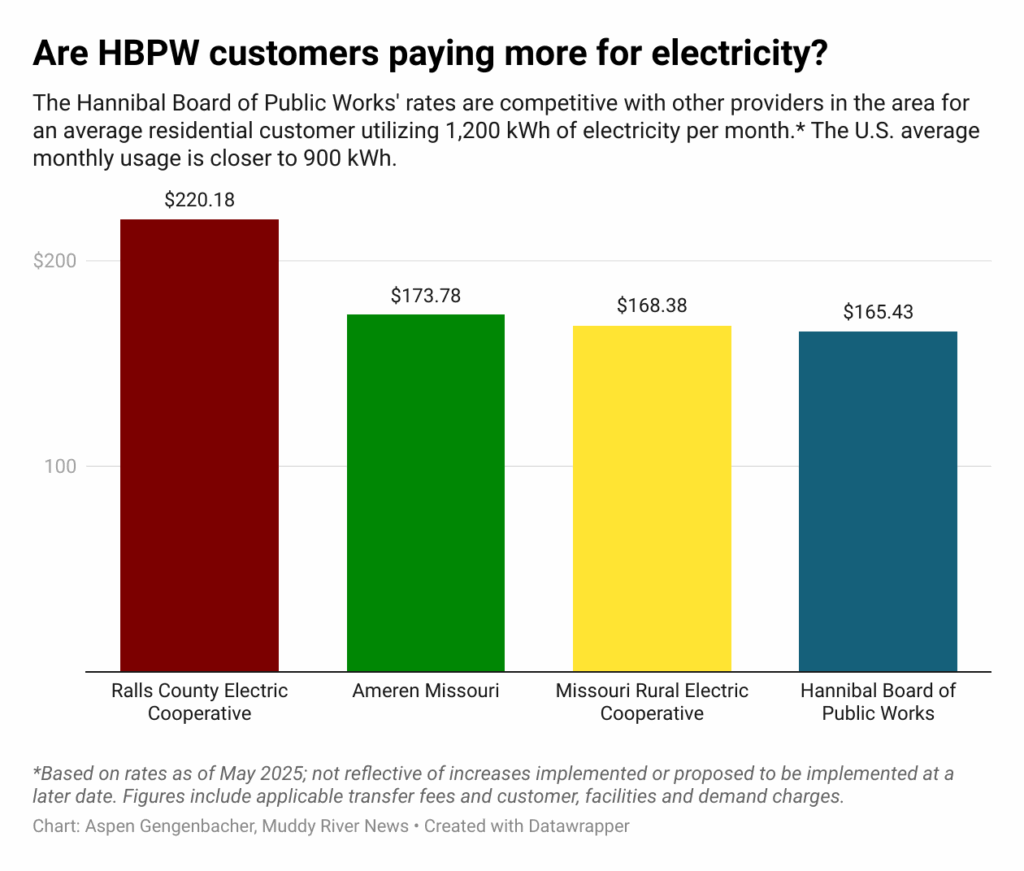

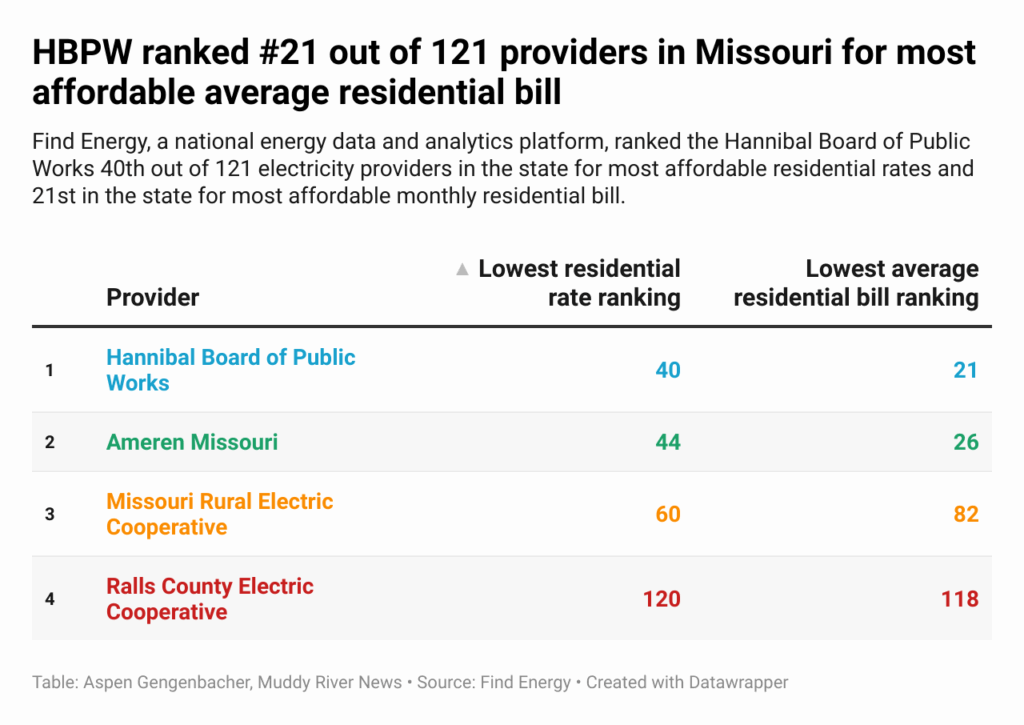

While savings weren’t determined to be as high as the city estimated, the $262,000 savings could potentially still result in a rate increase smaller than 12.2 percent but likely larger than 10 percent. Either way, the HBPW’s current and proposed rates are competitive with other area providers.

A small increase of about 3 percent went into effect April 1 for Missouri Rural Electric Cooperative customers. A 12 percent increase for Ameren Missouri customers was approved in April, down from the company’s original proposal of 15 percent. Ameren Illinois customers can expect a 50 percent increase from now through September.

“I will tell you we are absolutely not alone in this issue,” Trenhaile said at the hearing. “This is very much an industry-wide issue. The capacity is coming down while demand is going up. That’s not a formula that’s going to work in any type of business.”

If increases aren’t implemented and reserves aren’t replenished, the board risks losing the few advantages it still has left. The bond rating of its electric fund continues to drop, which affects the City of Hannibal’s bond rating, too. Lower ratings mean a lesser likelihood of securing loans for capital projects in the future without astronomically high interest rates.

Another potentially more severe outcome of not implementing an increase would be the triggering of a third-party group that could step in and force a rate increase to guarantee compliance with various covenants.

“Ultimately, this will cost the ratepayers of the HBPW and the taxpayers of the City of Hannibal more money in the long run due to having to pay more for interest,” Mitchell said.

As Hannibal residents brace for yet another rate increase, it becomes increasingly evident that the era of cheap, reliable and abundantly available electricity is over.

As the grid nears an unprecedented crossroads in modern energy history, the light at the end of the tunnel is flickering.

Miss Clipping Out Stories to Save for Later?

Click the Purchase Story button below to order a print of this story. We will print it for you on matte photo paper to keep forever.