Hannibal’s latest city budget, explained

HANNIBAL, Mo. — The Hannibal City Council officially approved the city’s operating budget for fiscal year (FY) 2026 at its June 17 meeting.

It’s the first budget created and passed since the departure of previous city manager, Lisa Peck, who was often criticized for a lack of transparency regarding the city’s finances by 2nd Ward Council Member April Azotea.

Azotea won her seat just weeks before Peck left Hannibal in May for a city manager position in Salem, Illinois. Peck was replaced by Andy Dorian, a longtime city employee who most recently served as the city’s central services director before being appointed as interim city manager by the council.

The difference between Dorian’s approach and that of his predecessor is observable in the first line of the 97-page document, which lists a much higher revenue amount for the city’s general fund of $19.4 million in comparison to last year’s amount of $13.28 million. The difference is due to the inclusion of the fund’s reserve balance, which functions like a savings account, in the total revenue amount.

“This year, Andy wanted to reflect the (general) fund reserve in a different way to make it more clear to the citizens,” finance director Bianca Quinn wrote in an email. “The fund reserve is part of the general fund, so we included it in the beginning balance.”

The general fund’s reserves were previously listed in the budget as the fund’s beginning balance. They were moved into two liquid investment accounts in 2022 to separate such funds from each year’s revenues, making it easier to identify budget deficits or surpluses and determine the reserve balance in real time — but harder for constituents to find.

Following the transfer of funds into the investment accounts, the general fund’s beginning balance amount was listed in the budget as $500,000 instead of the actual balance. Annually prepared general fund reserves reports have provided actual amounts, but have not been readily available to citizens.

Quinn said a hybrid approach was taken this year; the actual reserve balance has returned to the general fund’s beginning balance line, while separate lines for this year’s projected revenues and expenditures clearly show that the general fund will be operating at a deficit for FY 2026.

General fund highlights

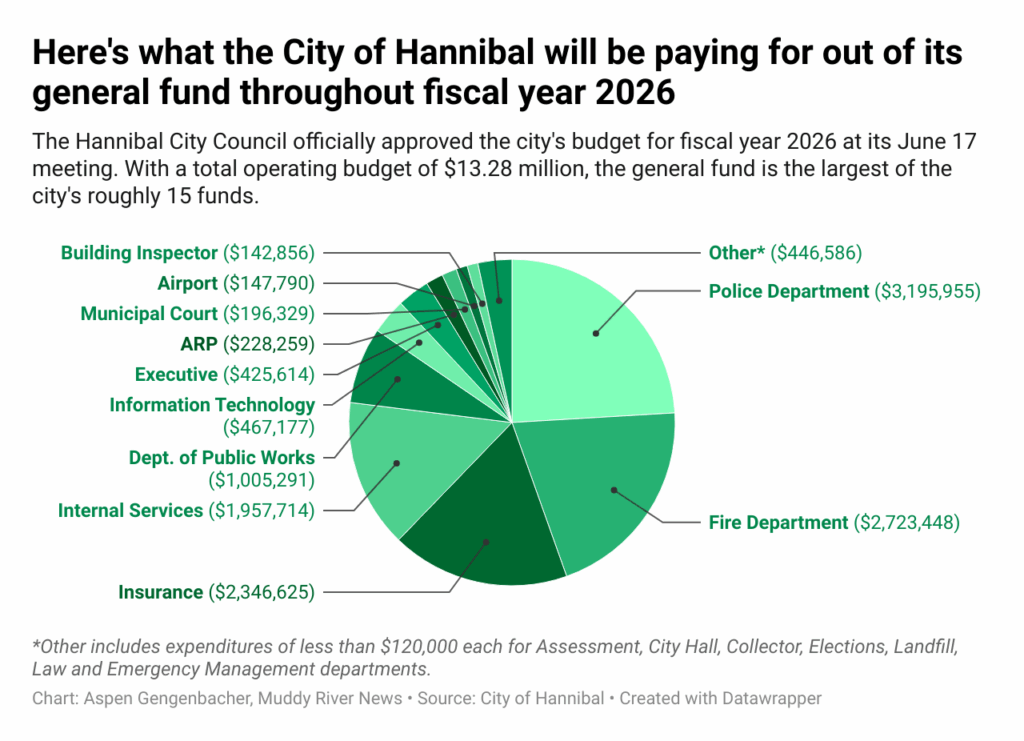

With a total operating budget of $13.28 million, the general fund is the city’s largest account. It funds most of the city’s departments, like police and fire, Hannibal City Hall and emergency management. Nearly $450,000 more in revenues and roughly $356,000 less in expenditures are projected in comparison to last year.

This year’s budgeted expenditures exceed anticipated revenue by roughly $50,000, a much smaller figure than last year’s budgeted deficit of $350,000. The account’s end-of-year balance is expected to be around $6.1 million.

Since all of the figures are merely estimates, a deficit isn’t guaranteed. For example, after accounting for $708,000 in additional expenses but more than $1 million in additional revenue, the budget for FY 2025 actually ended up with a surplus of roughly $6,600, not the $350,000 deficit that was projected.

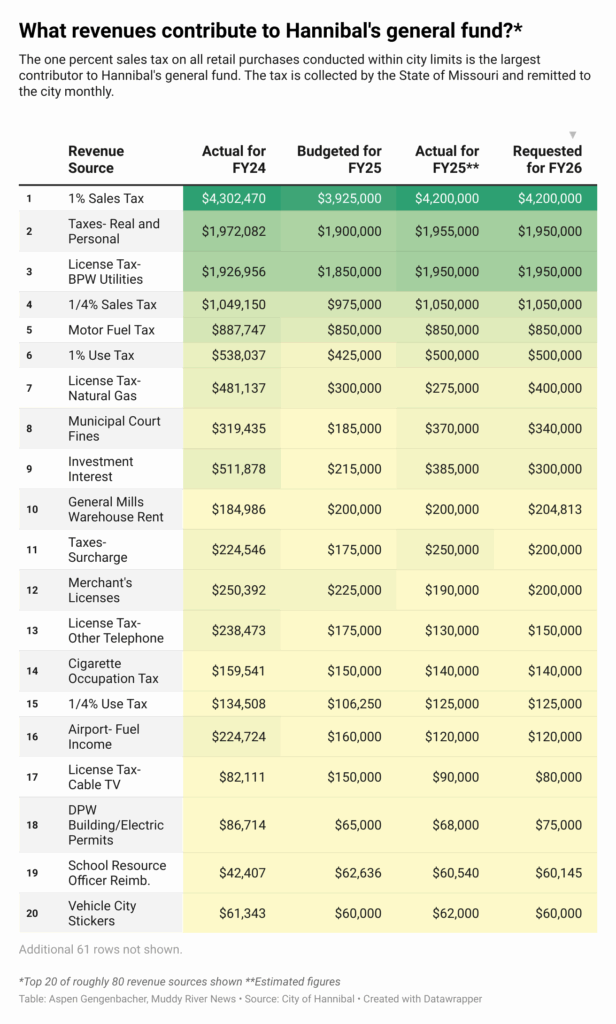

Generating a total revenue over $4 million, the one percent sales tax is the general fund’s largest revenue source. The tax is applied directly to consumers on all purchases made outside of the city, with the first $2,000 being exempt. The tax usually shows up on receipts as “state tax” because the state collects and disburses the funds to various municipalities monthly. As of a 2018 Supreme Court ruling, most large retailers like Amazon and Walmart automatically collect the tax at checkout.

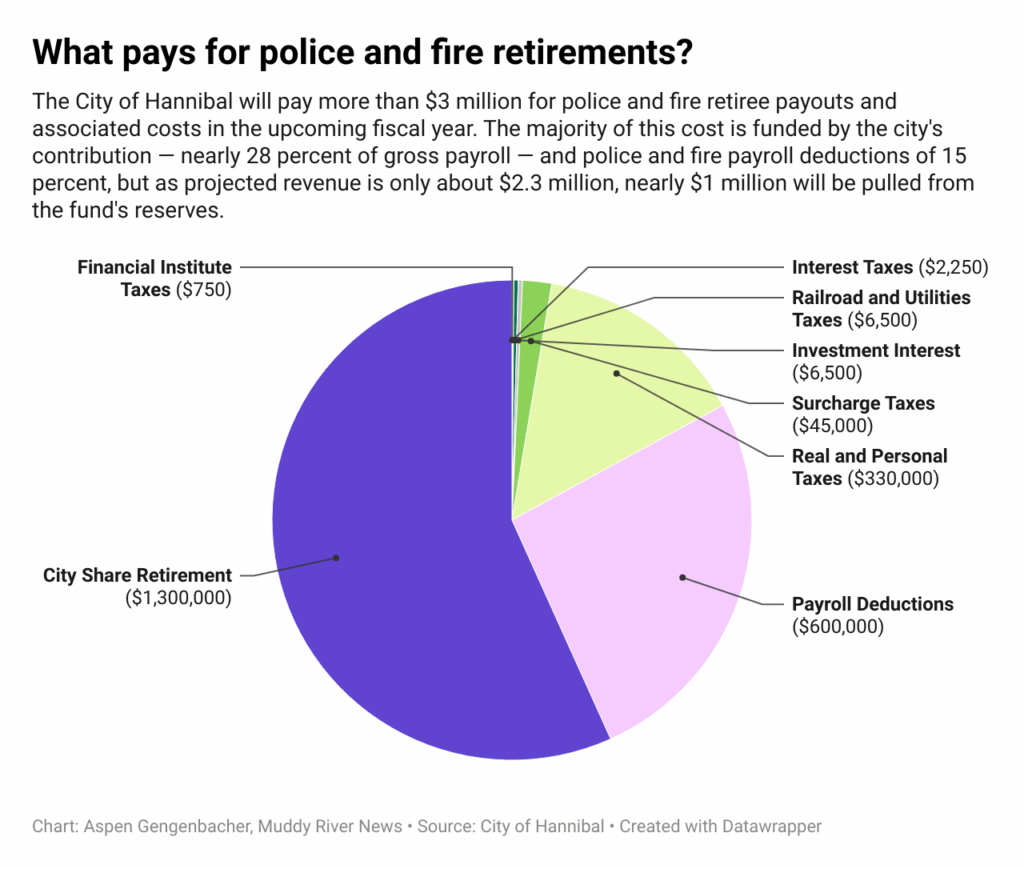

Tax revenue from real estate and personal property taxes also contributes a significant amount of dollars ($1.95 million) to the general fund, as well as to the funds for the library and police and fire retirements.

The Hannibal Board of Public Works (HBPW) is also estimated to generate $1.95 million in revenue for the general fund this year. A 5.5 percent franchise fee is imposed on the Board’s gross revenues of all water and electric services and is paid to the city monthly, per the city’s charter.

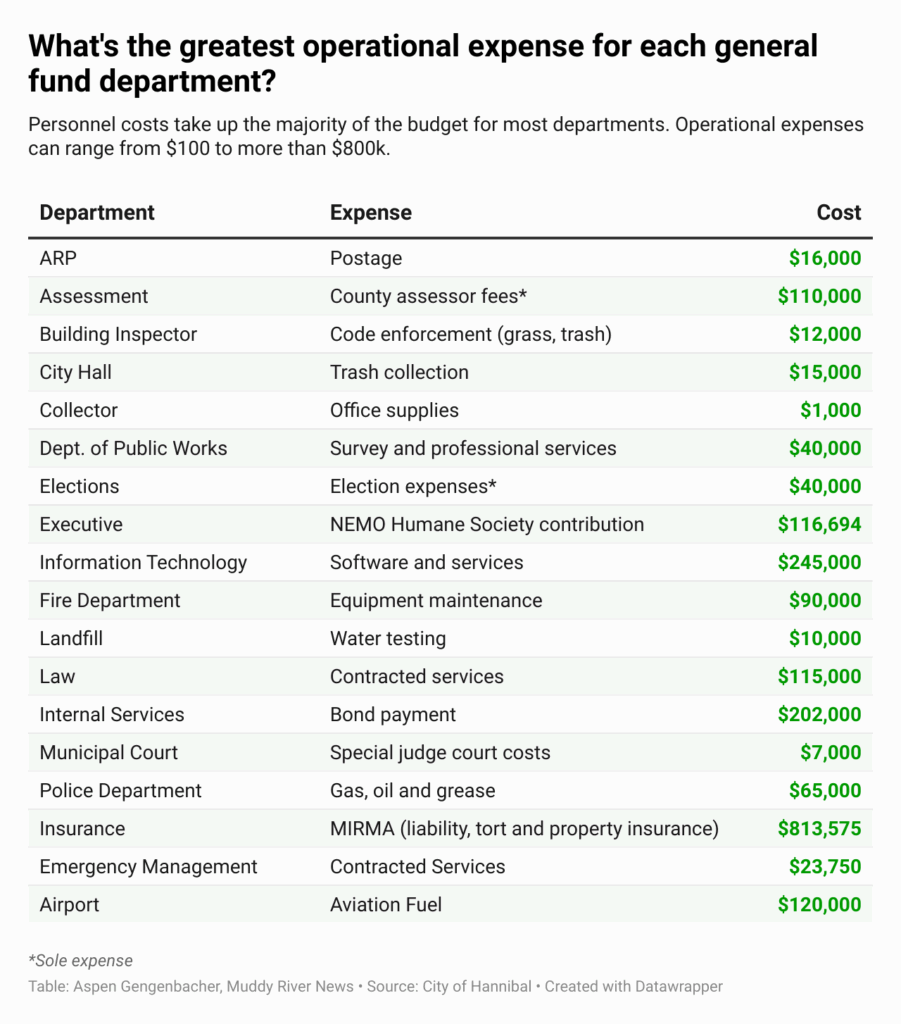

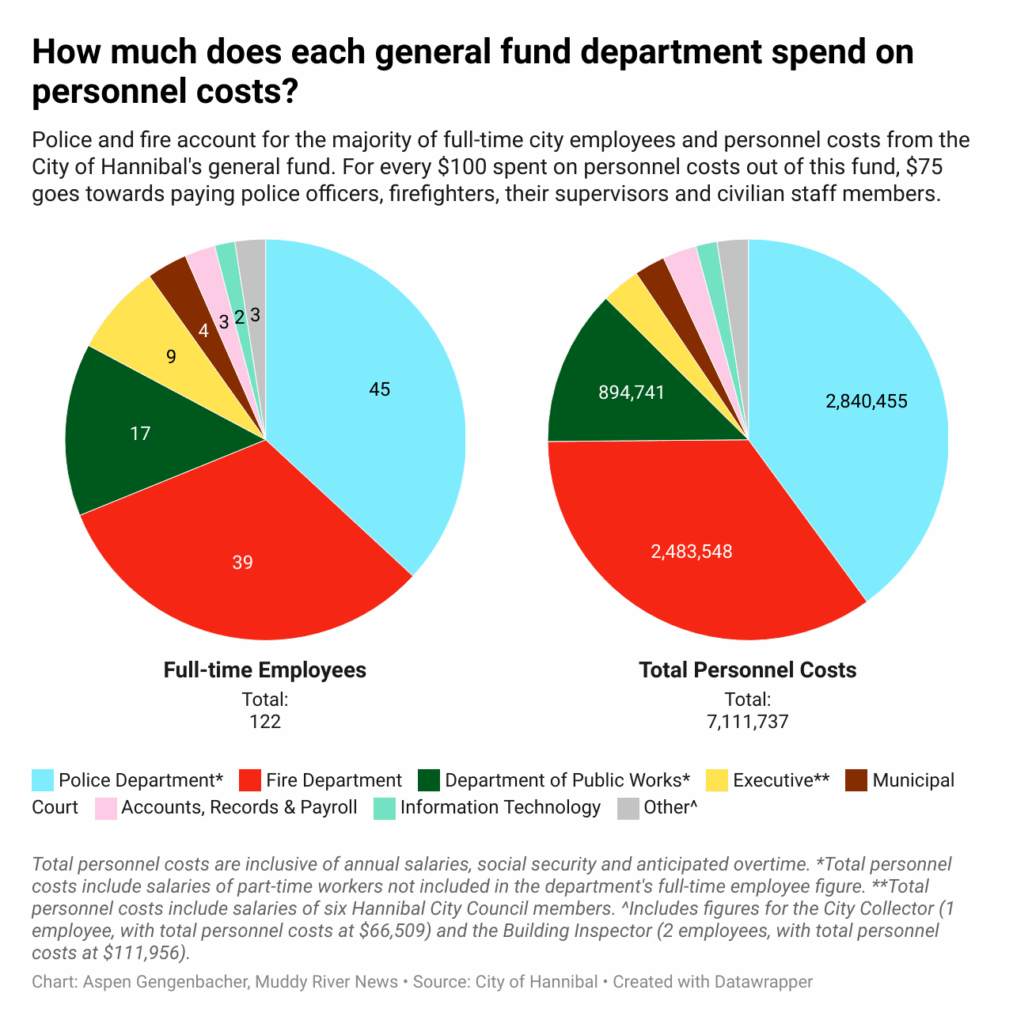

The Hannibal Police Department (HPD) has the largest budget of the general fund departments, as well as the most full-time employees. The Hannibal Fire Department (HFD) has the second largest budget and the second-highest number of full-time employees. HPD’s highest operational cost is for gas, oil and grease for the year at $65,000, while equipment maintenance costs of $90,000 is the HFD’s highest operational cost.

The budget for elections nearly doubled from last year in anticipation of a potential Public Safety Tax proposition. The tax has been a frequent topic of discussion on the council in the context of the city’s funding disparities for police and fire. The Missouri State Legislature passed a bill in the spring to allow Hannibal to impose the tax to support the departments, but voters have to approve it first.

Personnel costs eat up the majority of the budget for most general fund departments, but some departments, like elections and assessment, have none.

Some personnel costs are split between departments and funds, like the salaries for the central services director, fiscal management assistant and the public works management assistant. Those positions are partially funded by the Department of Public Works, which is completely separate from the Board of Public Works and is financed by the general fund, and Parks and Recreation, which has its own fund.

“Because the city cuts costs wherever possible, these positions take care of tasks for both departments, increasing our efficiency and keeping labor costs lower,” Quinn said. “The Parks fund is separate from the general fund; consequently, the cost is split between the two. You will find that many employees in the city wear multiple hats.”

The latest budget established an Information Technology (IT) Department, which has two employees and a total budget of roughly $467,000. The costs were previously included in the budget for the Internal Service department.

The Internal Service Department has a budget of nearly $2 million, most of which ($1.53 million) is contributed to pension funds for city employees of departments funded by the general fund, including police and fire, which is transferred into a separate police and fire retirement fund (fund 81).

More than $1.5 million of the Insurance Department’s $2.3 million budget goes towards medical and dental premiums for individual and dependent health insurance coverage; this money is transferred into a separate employee trust fund (fund 40). Another big chunk ($813,575) goes to the Missouri Insurance Risk Management Association for liability, tort and property insurance.

Infrastructure tax, sales tax and capital expenditures highlights

The half-percent sales tax generates the bulk of the infrastructure tax fund’s (fund 28) revenue. The tax was imposed for the sole purpose of financing city-wide infrastructure and remedial improvements.

More than half of the fund’s $800,000 budget will be spent on street paving. As projected revenues exceed estimated expenses, a surplus of roughly $1.6 million will be added to the fund’s reserves. The fund’s year-end balance is estimated to land around $4.58 million.

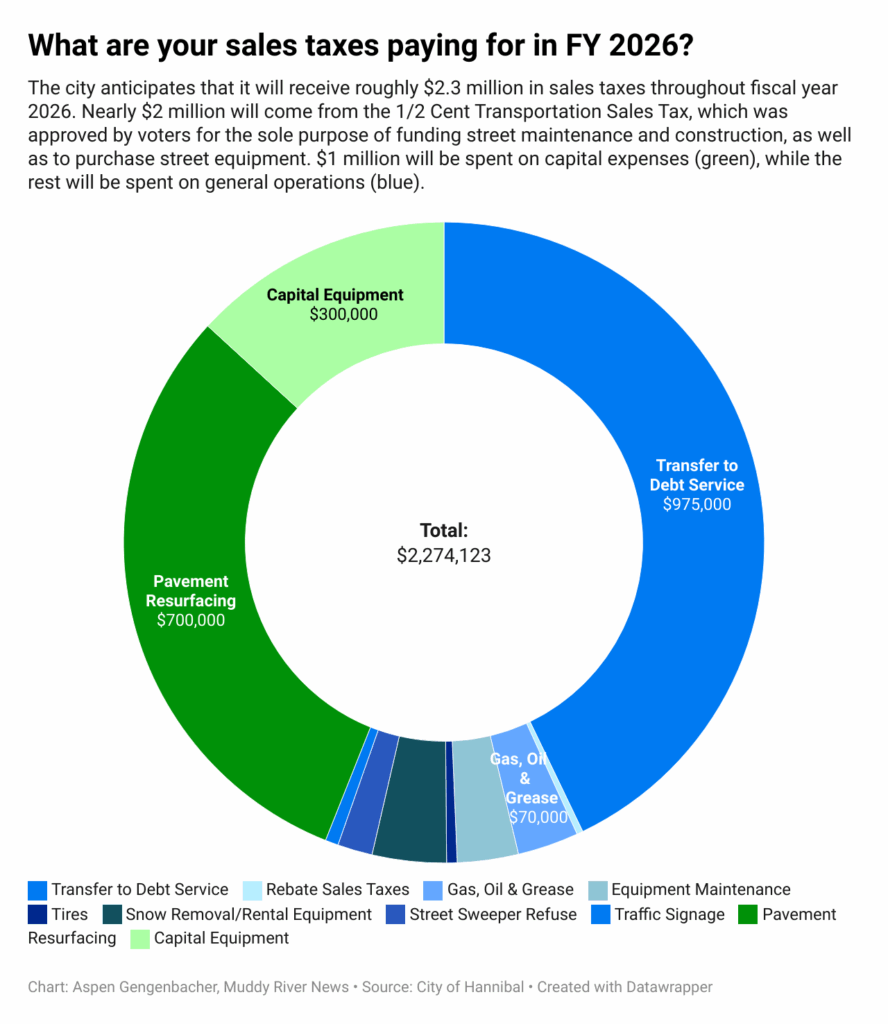

A half-percent capital improvement sales tax on all retail purchases in the city is the largest revenue source for the capital sales tax fund (fund 30), with an estimated revenue of nearly $2 million for FY 2026. Estimated expenses come in around $6,000 less than projected revenues, and the year-end balance for this fund is estimated at roughly $2.46 million.

A grant of more than $6 million for the multi-phase North Street Culvert Replacement Project makes up the bulk of revenue and expenses for the capital expenditures fund (fund 45), which finances various capital projects for general fund departments.

The airport is budgeted to spend $950,000 of capital dollars on jet fuel and fuel systems. City Hall will spend $470,000 to replace its failing boiler system, contribute a 20 percent funding match for sidewalk replacements in front of St. John’s Lutheran Church and Eugene Field Schools, and budget for necessary building repairs over the next three years.

HFD is anticipated to spend nearly $300,000 on a lease payment for a ladder truck, remodeling costs for Fire Station 1 and its admin building and the replacement of outdated bunker gear and vehicle extraction equipment. HPD will spend $90,000 in upgrades to their records management system and improvements to the building and parking lot of its gun range.

The capital expenditures fund’s expenses are estimated to exceed its revenues by nearly $1.2 million, though additional grant revenue is anticipated. The year-end balance is estimated at nearly $2.2 million.

Parks and tourism highlights

The Parks and Recreation Department has its own fund (fund 38) and budget, which is roughly $3.16 million for FY 2026. About $2.5 million in revenue is expected, resulting in a projected deficit of nearly $660,000 and an end-of-year balance around $1.4 million.

The largest revenue source for the department is a sales tax of one-half percent on all retail purchases within city limits ($1.96 million).

The bulk of expenditures will be spent on capital improvement projects, the largest of which is the Central Park Renovation Project ($1 million) to replace damaged concrete around the bandstand, fountain and sidewalks. Other capital expenses include pool filter repairs, new infield dirt for Clemens Field and the purchase of a new snow plow truck and a zero-turn mower.

Tourism also has its own fund (fund 48) and budget, which is projected to end the year with a surplus of roughly $105,000 and a fund balance of about $1.7 million. The majority of the fund’s roughly $1 million in projected revenue ($880,000) will come from a 6 percent lodging tax.

The biggest expenditures for the department will be spent on personnel costs for two full-time employees and several seasonal and part-time employees, advertising and promotion and costs associated with state grants.

A full copy of the FY 2026 budget can be found on the city’s website.

Miss Clipping Out Stories to Save for Later?

Click the Purchase Story button below to order a print of this story. We will print it for you on matte photo paper to keep forever.