Lack of clarity on future local grocery tax implications forces City Council to table vote for two weeks

QUINCY — The debate over a proposed 1 percent municipal grocery tax, which would replace a state tax that is scheduled to sunset on Jan. 1, 2026, was just getting warmed up when Alderman Mike Rein (R-5) offered a question to Comptroller Sheri Ray during Monday night’s Quincy City Council meeting.

“This replacement tax for next fiscal year, it’s only for the last quarter, correct?” Rein said, receiving a head nod from Ray. “If (the tax) was (going to generate) $1.2 million for next year’s budget, we’re only looking at a $400,000 gap. … If we don’t pass it in 2025, can we pass it in 2026, or is this a one-time (window) and then it’s gone?”

“I don’t really know,” Ray replied.

After a few minutes of discussion, with Treasurer Kelly Stupasky joining in, Ray said, “We have until October (to implement the tax with a seamless transition). So, I mean, if you guys would feel comfortable, we could look into it.”

Tony Sassen (R-4) quickly made a motion to table the vote on the proposed tax for two weeks, which was seconded by Rein and passed unanimously by the full council.

Earlier in the discussion, Greg Fletcher (R-1) asked if the city expects to move on “fairly decent, without layoffs or anything like that,” if the grocery tax is not implemented in Quincy.

Ray said she’s in the early stages of developing the Fiscal Year 2025-26 budget, but she is forecasting revenues at a little more than $50 million. She said budget requests from city departments are coming in at around $55 million.

“There is a $5 million deficit, and we will work with departments over the next few weeks to kind of whittle that deficit down,” she said. “We can make the best guess estimate that (a local grocery tax would bring in) over a million dollars. If we don’t extend the tax, it just it’ll make that gap a little wider.”

“With sharpened pencils and watching what we do moving forward, if we don’t renew that tax, it doesn’t have to be that in the world, does it?” Fletcher asked.

“I guess it doesn’t, but I always feel like we go in these cycles,” Ray said. “We have a problem. We lay off policemen, and we lay off firemen, and we always lay off the guys at the bottom, the new guys who just got hired get furloughed, or we postpone hiring until someone leaves. It’s a four- or five-year cycle, and then all of a sudden, it’s a political move to get back to full staffing.

“I just feel like we need to be consistent. Let’s do a forward look. How do we think revenues are going to grow over the next four years?”

“I would never support laying anybody off,” Fletcher said.

“Well, I’m just saying I’ve only been the comptroller for a short time, but I feel like in that time, that’s what we’ve done,” Ray said. “You’ve got to remember salaries and benefits, and especially in public safety, with pension costs next year over $10 million, we know that number is going to keep growing. I feel like it’s important for us to kind of maintain the tax base we have.”

Stupasky told aldermen he believes if they don’t pass the local grocery tax by Oct. 1, he doesn’t believe the city can bring it back as a grocery tax.

“You would have to do something like increase the home rule (sales) tax, but you couldn’t bring it back as grocery tax. That’s my understanding,” he said.

“So the window just slams shut if we don’t do it,” Rein said before Ray made her offer to investigate the issue more.

A Jan. 16 story by Dylan Sharkey for Illinois Policy said Illinois is one of only 13 states with a grocery tax, and it is the only state among the 10 most populated. Sharkey wrote that 46 Illinois towns will continue the 1 percent grocery tax once the statewide tax ends in 2026, according to data from the Illinois Department of Revenue. One of them is Normal. Its town council voted 4-3 in September 2024 to institute the local tax.

Eliminating Illinois’ grocery tax has the backing of 7 in 10 Illinois voters, according to an Illinois Policy Institute poll conducted June 26-29, 2023, by Echelon Insights for the Illinois Policy Institute.

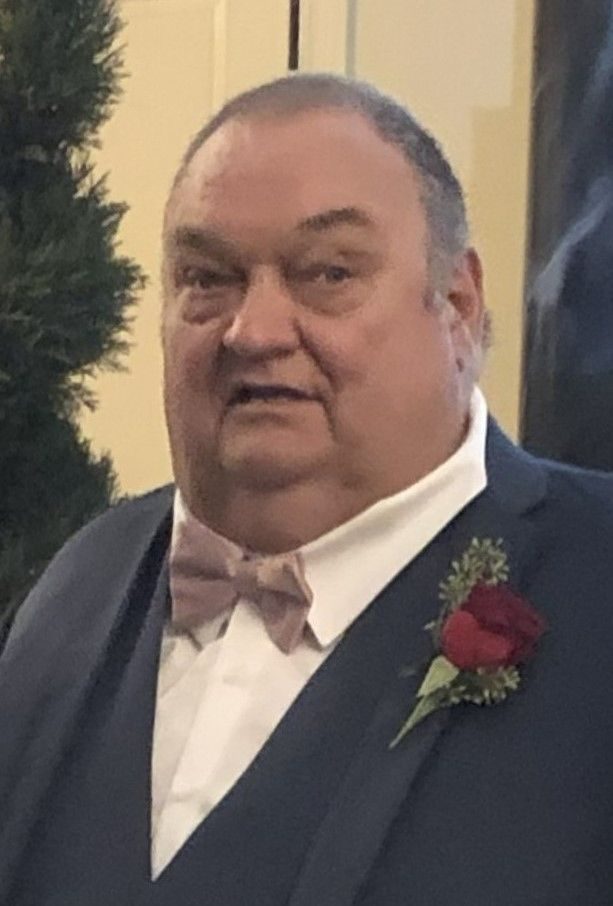

Fire Chief Bernie Vahlkamp, who is retiring Friday after 27 years with the Quincy Fire Department, was showered with plaques, keys, certificates and other gifts at his last City Council meeting.

“It’s just been a pleasure to work with Bernie Vahlkamp,” said Barry Cheyne, chairman of the Quincy Fire and Police Commission. “You want somebody in a leadership position who has the tactical, operational and strategic vision to do what’s right for the department. He has that, and he displayed that. Not only did he take care of his men, he gave them the latitude to improve the workplace.”

Vahlkamp’s last act as chief was the swearing-in of two firefighters. Kyle Vandermaiden is a 2012 graduate of Unity High School and received a bachelor’s degree from Illinois State University in 2017. He has worked full-time for Adams County Ambulance and EMS and part-time for Tri-Township Fire Department during the last two years. Andrew Stegeman graduated from Quincy High School in 2017 and earned an associate degree from Southern New Hampshire University in 2023. He served in the Army from 2017-2022 and has worked at Knapheide since 2022. Both men will attend the Fire Service Institute in Champaign starting March 3.

Steve Salrin, who will become the new chief on March 1, said the department now is fully staffed with 60 employees.

In other action, aldermen:

- Gave permission to the South Side Boat Club to conduct a raffle.

- Approved a special event application from Scott Moore of the Early Childhood and Family Center, 401 S. Eighth, to hold its annual student parade in recognition of the “Week of the Young Child” at 10:00 a.m. and 1:30 p.m. on Monday, April 7.

- Approved a new vacation policy. Kelly Japcon, director of human resources and risk management, said employees will receive three weeks of vacation after five years on the job (instead of seven) and five weeks of vacation after 25 years on the job (instead of 30).

- Approved a resolution from the Illinois Department of Transportation that the city will receive $574,000 in motor fuel tax for the 2025-26 Fiscal Year. The city will receive $150,000 for traffic signal and street light maintenance, $42,500 for asphalt patching material, $37,550 for concrete, $290,000 for rock salt, $31,000 for miscellaneous items and $23,000 for advertising and engineering.

- Approval for a change order requiring $188,896 in additional spending for the 2024 alley and capital improvements project.

- Approved changing the zoning of 504 N. 54th from RU1 (rural/agricultural) to C2 (general commercial).

- Learned curbside yard waste pickup will begin March 17.

- Learned Harrison east of 24th Street will be closed beginning March 10, and Rein said the closure will last “for months.” Rein said people who want to head west on Harrison will have to use a detour on 28th Street and Monroe.

Miss Clipping Out Stories to Save for Later?

Click the Purchase Story button below to order a print of this story. We will print it for you on matte photo paper to keep forever.