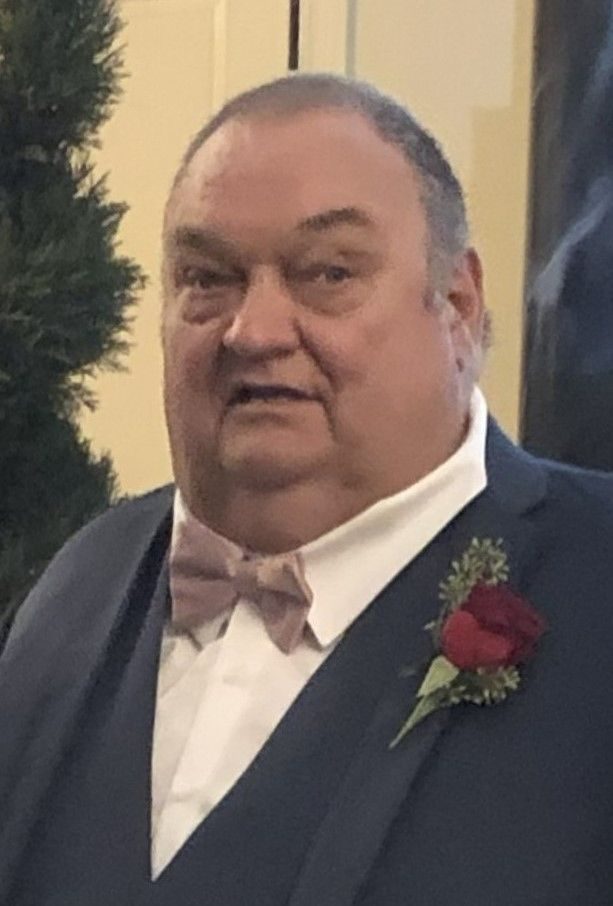

McGee says QU future is bright, takes umbrage with reporters who ‘took potshots’ in story on school’s finances

QUINCY — Brian McGee, president of Quincy University, said a St. Louis Post-Dispatch story detailing financial troubles at the school was written by two reporters “taking potshots,” and the story contained information that was either “puzzling,” “wrong” or “incomplete.”

McGee also said the future of the university is “bright.”

A March report from the Scholarship Foundation of St. Louis said 37 colleges attended by foundation students have shown signs of significant financial distress in one or more of the last five years. Quincy University was one of 10 schools highlighted because of “special concern” due to recent financial scores and disclosures.

The Scholarship Foundation report was part of the Post-Dispatch story that was published Saturday and written by Blythe Bernhardand Steph Kukulian. The story also painted a brief financial picture of Quincy University, saying:

- Quincy has a declining number of students (1,113).

- The university’s debt ($36 million) is higher than its endowment ($21.5 million as of 2022).

- QU was considered “not financially responsible” in 2022 on a scale of eligibility for federal financial aid programs.

McGee took issue with each statement.

Regarding the “declining number of students,” McGee said, “Well, compared to years or decades ago, I suppose that’s true. But Quincy University had its largest freshman class in 50 years this fall and its largest freshman class in 30 years the year before. One thing I’m sure of is that we’re growing enrollment right now. I believe we will do so again this fall based on all the data we have.

“(The reference to declining enrollment is) a head scratcher, because I don’t know what they’re measuring for decline.”

Figures provided by the college dispute the number of students enrolled according to the Post-Dispatch. They also show enrollment has increased 9.6 percent since the 2017-18 school year.

| School Year | Total Quincy University Enrollment |

| 2023-24 | 1203 |

| 2022-23 | 1250 |

| 2021-22 | 1156 |

| 2020-21 | 1124 |

| 2019-20 | 1122 |

| 2018-19 | 1185 |

| 2017-18 | 1098 |

Asked about the university’s debt versus endowment, McGee said, “I’ve got shocking news for you: QU is not rich. I’ll note the obvious. Every university and every business in the country uses debt and assets and leverages them against one another to produce the best possible result.”

McGee said two reasons the university has debt is because it put money into building the Student Living Center, a $5.2 million residence hall that opened in 2011, and the Health and Fitness Center, a $10.7 million project in 2001 that included renovations in Pepsi Arena.

“You’d have a hard time imagining Quincy University succeeding without those facilities,” McGee said. “We used debt that way, for example, years ago with a long-term commitment to paying it off.”

McGee bristled when he read the comment that the university was not “financially responsible” for financial aid programs.

“That one is just the reporters not understanding higher ed,” he said. “There are two ways you can be financially responsible. One is to earn a score that involves a complex evaluation of debt versus assets. Our score has been up and down over the years, depending on how much cash we were holding at a particular moment. For example, it’s a single-point-in-time measurement. It’s complicated, and most of us in higher ed don’t think it’s a very good measure, but the U.S. Department of Education hasn’t come up with one better. You can earn a certain score on that.

“Or you can post a bond to be financially responsible. That would be what Quincy University did. We are financially responsible as far as the U.S. Department of Education is concerned.”

An audit prepared by Grey Hunter Stenn for the year ending May 31, 2023, said, “To continue participation in any Title IV federal program, the university must demonstrate to the secretary of the U.S. Department of Education that it is financially responsible under the financial responsibility regulations established by the department or post a letter of credit in favor of the department and possibly accept other conditions on its participation in Title IV programs.”

The financial responsibility regulations required the university to:

- satisfy its obligation to students and to the secretary and be current in its debt payments;

- administer properly the Title IV federal programs and

- have the resources necessary to provide and continue to provide the education and services described in its official publications and continue to satisfy its financial obligations.

The composite score used by the U.S. Department of Education to determine financial responsibility uses three factors: primary reserve ratio, equity ratio and net income ratio. The composite score will be in one of three ranges:

- Financially responsible enough to participate without additional monitoring;

- In the “zone” requiring additional monitoring, and

- Not financially healthy enough to be considered financially responsible.

QU’s composite score was in the “not financially responsible” range for the years ending May 31, 2023 and May 31, 2022.

However, the Gray Hunter Stenn audit said the university could continue participating in Title IV programs by submitting a bonding requirement to the Department of Education. QU entered into an irrevocable letter of credit agreement for approximately $3.6 million to satisfy a 50 percent alternative requirement for participation in Title IV programs. The agreement was collateralized by a third mortgage on the North Campus property and $3.4 million of endowment fund investments.

McGee said he had never heard of the Scholarship Foundation of St. Louis before reading about it in the Post-Dispatch story.

“We recruit in St. Louis, and I’m sure we have recruited students who had received the services of this scholarship foundation,” McGee said. “They have a lovely mission, and they’re trying to help young people get to college, More power to them. But their list of 37 schools that are at risk of closure is just shocking to me.”

He noted two of the schools on the foundation list of 203 schools with financial problems were the University of the Incarnate Word in San Antonio, Texas, which McGee says has an endowment of more than $175 million, and Rose-Hulman Institute of Technology in Terre Haute, Ind., which McGee says has an endowment of more than $200 million.

“The one thing I can tell you about Rose-Hulman is they don’t have any financial crises to worry about anytime soon,” McGee said. “(The list of schools with financial problems) is a head scratcher because I just don’t understand (the foundation’s) methodology. (The foundation has) a great mission. They probably are not sitting there with multiple former college presidents or college chief financial officers, helping them figure this out, with all due respect.”

McGee said students, in today’s environment, would be wise to investigate if colleges or universities are operating in a financially responsible way.

“A university that has declining enrollments, has had budget cuts or is cutting staff are going to cause questions,” McGee said. “In our case, I just mentioned things that we’re not doing. Our trends are in the right direction.”

McGee said the university’s plan for the future includes enrollment growth at the undergraduate level and the development of new programs. He said revenue growth this past year — “in an audit you haven’t seen yet,” McGee said — was the largest it has been in the modern history of the institution.

“The plan is working,” he said. “It will take several years to be as good as we’d like it to be. I think world domination will take QU a while, but we are emphatically moving in the right direction. Quincy University is on solid footing. It is growing. It is serving more students and serving our community more effectively. The future of the institution is bright. Let me put it another way. There’s a reason I just signed a contract extension through 2029.”

McGee compared the financial situation of the university to the average American family.

“How many people do you know who have debt on a car, debt on a house, don’t have a lot of savings, and they have a job that if they lost it, they’d be in some trouble?” he said. “But we don’t look at them every morning and say, ‘Oh my God, they’re at such risk for bankruptcy.’

“It is true that college enrollment is declining nationwide. It’s true that a lot of universities are having to change their strategies and change their planning. But in the end, most of them are going to succeed at adapting to the changing environment. These are institutions that are somewhere between 100 and 175 years old. They have figured out how to make it work. There will be some universities in Missouri and Illinois in the next several years that close. I don’t think Quincy University is going to be one of them.”

Miss Clipping Out Stories to Save for Later?

Click the Purchase Story button below to order a print of this story. We will print it for you on matte photo paper to keep forever.