‘There’s bias against TIF South’: Austin asks aldermen to give program same attention other investment deals receive

QUINCY — The Quincy City Council is scheduled next week to make a long-awaited vote on an ordinance approving a tax increment financing plan on Quincy’s south side.

However, a discussion between a member of the Adams County Board and two aldermen indicated the vote might be delayed yet again.

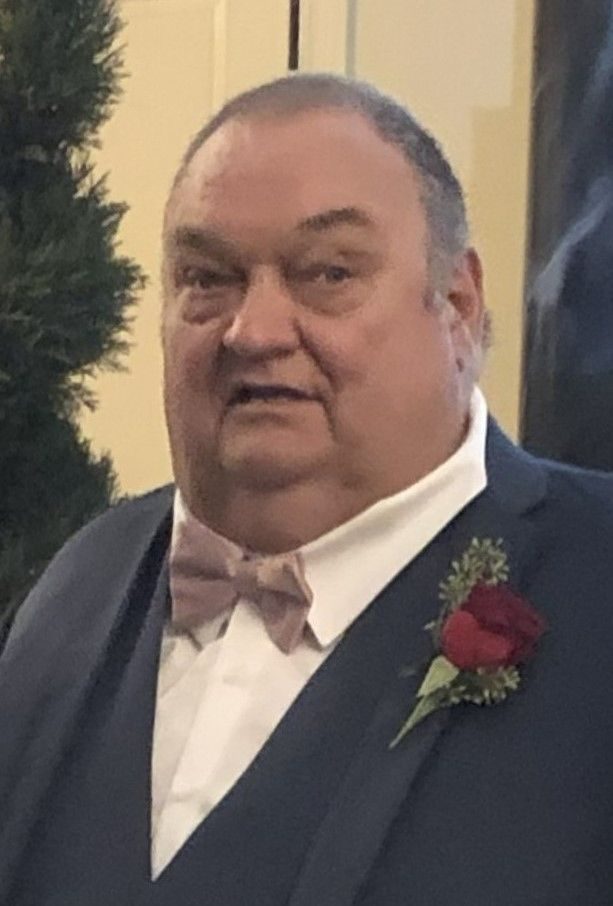

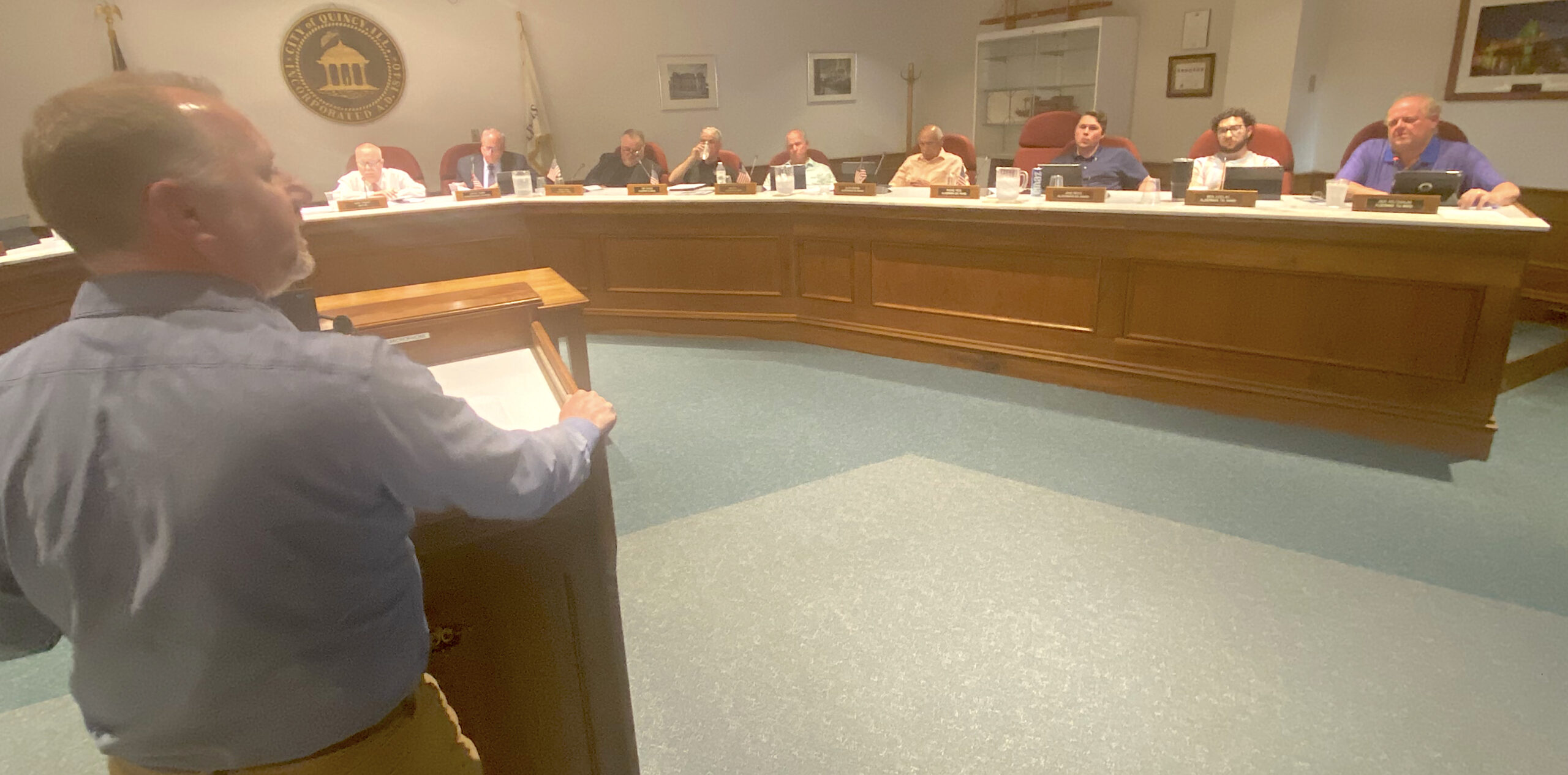

Bret Austin represents District 1 on the Adams County Board and also serves as the board’s chair of the Finance Committee. During the public forum at the beginning of Monday’s City Council meeting, he told aldermen that it “has become apparent that there are some very uninformed statements going around to the point of creating almost virtual conspiracy theories out of what should be a pretty-easy-to-digest economic development incentive program.”

“The proposed TIF South is not a backroom deal, as some (aldermen) have mentioned here,” Austin said. “It is a thoroughly vetted process requiring a licensed consultant and approval from a state legislator. How anyone could call this process secretive after it has been so dissected in the media and several committees and board meetings is beyond my understanding. This issue has got to be one of the most discussed tax issues in recent memory.

“The fact that there’s so much council opposition to this issue — in spite of overwhelming stakeholder support, in spite of the fact that we have decades of success with these programs, in spite of the fact that a licensed consultant says we met the criteria, in spite of the fact that the vast majority of taxing bodies had no issue with the proposed program, and in spite of the fact that other private/public investment deals were being made concurrently in other areas of the community for sums of money larger than the TIF amount — leads me to only one conclusion. There’s bias against TIF South because of who is involved in support of it, who is involved in ownership of the properties and because of a narrative that somehow the district is being given an unfair advantage that other wards don’t get.”

Ben Uzelac (D-7) asked Austin if he was in favor of the tax rebate that aldermen approved last week for the former Sears building at 3400 Broadway. Austin said he was.

“That developer and that company have proven track records. We absolutely should be supporting them,” Austin said. “But it’s an inherent bias … when that deal is worth 10, 20, 100 times more money than we’re talking about with TIF South. Somehow they slide right through, and they’re passed unanimously. I agree with those deals.”

Georgene Zimmerman represented the Adams County Board when the Joint Review Board voted 5-1 in favor of TIF South. However, Jeff Bergman (R-2) questioned last week how each of the representatives of the city’s six taxing bodies were informed of how to vote.

“If that’s what it takes, and (the County Board needs) to do a redo vote, fine,” Austin said. “But inherently, it does not look like the same attention is being given to both types of deals.”

“Do you think we should table our vote on the TIF until we hear from the county?” Jack Holtschlag (D-7) asked.

“Absolutely,” Austin replied. “Why not? I mean, at this point, if you want full vetting, Bergman brought it up. That’s the one valid question that I heard in all of this. That was a great question. If you feel like the process wasn’t fair and valid, that’s fine. But again, it went on for months and months and months.

“If you want to table this until (May) 20th … and see what (the County Board comes) up with, go for it, but at least give it valid and fair consideration that’s the same, because you are not.”

Quincy Mayor Mike Troup said city officials have been contacting the other five taxing bodies about their process for how their vote was cast for the Joint Review Board.

“We went back to say, ‘Can you write a letter? Did you talk to people digitally? What action did you take?’” Troup said. “We’re getting those letters back. We’ve got something from the (Quincy) School District that just came in today. John Wood (Community College) is supposed to be sending us a clarification letter. The county said they wanted to have a discussion at their next meeting.

“With all that, we’re hoping to have something by mid-May. We don’t expect it to change the outcome. We’re optimistic we’re going to get that approval.”

In other action, aldermen:

- Gave permission to have the Air Evac helicopter at the Quincy Town Center south parking lot behind First Bankers from 1-3 p.m. May 19 for “EMS Days.”

- Gave permission to have the alley behind 625 Maine from Sixth to Seventh closed with barricades on May 13 for a Quincy High School senior class party at the Quincy Axe Company and First Mid Bank courtyard.

- Allowed Gem City Gymnastics & Tumbling LLC to conduct a raffle from June 3 through August 1.

- Gave Scott Edlin permission to hold concerts between 4 p.m. and midnight on May 25-26 and June 21-22 in Lincoln Park, 1231 Bonansinga Drive. Eric Entrup (R-1) asked for city officials to investigate which direction the speakers will be directed on those nights.

- Approved the installation of a ground-mounted automatic changeable copy (digital) sign at the Unitarian Church, 1479 Hampshire.

- Approved the operation of a golf pro shop at 830 S. 36th that would include retail sales and a commercial kitchen and to allow for the issuance of a liquor license as a means to sell alcohol and to operate video gaming terminals.

- Entered into a two-year agreement with A Clean Slate, owned by Tammy Riley of Hannibal, Mo., to provide custodial services for the Quincy Police Department at a cost of $28,488 per year.

- Approved an ordinance amending city code to reduce the length of the review period from up to 90 days to 45 days for the filing of a demolition permit to survey, review, comment and document a property if the property contributes to a National Register Historic District.

- Approved an ordinance amending the 2023-24 Fiscal Year budget, making a supplemental budget ordinance for the General Fund to increase police funding and decreasing fire funding by $92,000, closing out $5,111 in the fire education fund, closing out $4,942 in the recycle fund and appropriate $24,332 for other post-employment benefit (OPEB) trust revenues and $917 in OPEB expenses.

Miss Clipping Out Stories to Save for Later?

Click the Purchase Story button below to order a print of this story. We will print it for you on matte photo paper to keep forever.