The Illinois municipal pension problem

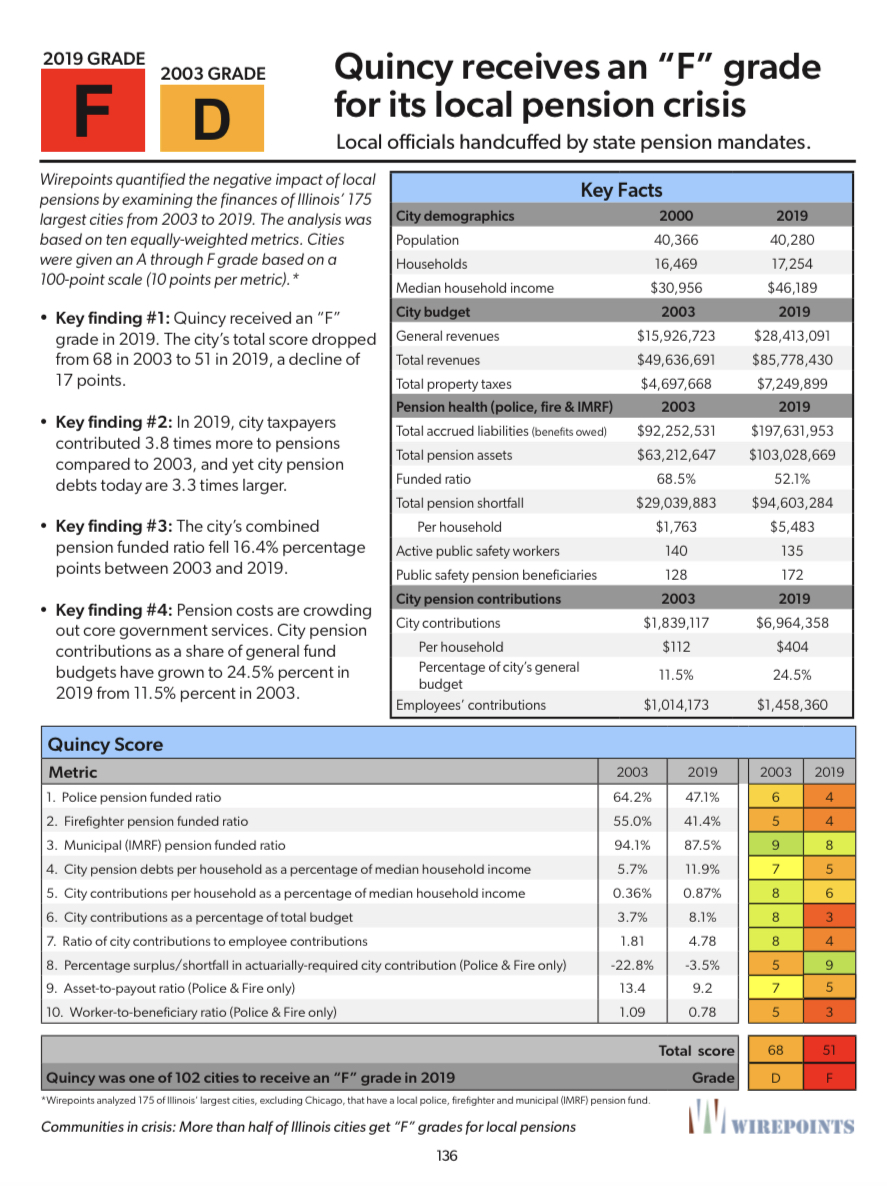

A study from WIREPOINTS shows that 102 of 175 measured cities in Illinois, including Quincy, received failing grades on their pension systems.

llinoisans are suffering from more than just the nation’s worst state-level pension mess. For most residents, another problem hits much closer to home: Illinois’ local pension crisis.

Complicating the situation is the fact that local officials can do little about the crisis. Local retirement costs are largely a consequence of the state’s top-down, one-size-fits-all mandates which prevent cities from actually solving their pension problems. Instead, city officials are forced to choose between three undesirable responses: raising taxes, cutting back on services, or endangering the retirements of city workers.

Wirepoints has quantified the negative impact of local pension costs by examining the finances of Illinois municipalities from 2003 to 2019. To allow for a like-for-like comparison, coverage was restricted to the 175 cities, excluding Chicago, that have their own independent police, firefighter, and Illinois Municipal Retirement (IMRF) pension funds.

Wirepoints found that while just seven of the 175 measured cities received an F grade in 2003, that number had grown to 102 cities by 2019.

Quincy Mayor Mike Troup said the city’s pension situation has slightly improved over the last year because of market circumstances. He acknowledged in an interview that the city’s police and fire pensions need the most attention while IMRF is in better shape.

Troup said he has already reached out to several state officials and will attend a meeting in Chicago later this month to discuss options regarding the pension crisis.

The analysis was based on ten equally-weighted metrics, ranging from the funded ratio of each local pension system, to the pension debt each household is on the hook for, to the share of city budgets consumed by pension costs. All cities were given an A through F grade based on a 100-point scale (10 points per metric), with 100 being the best score. Wirepoints’ analysis was based on data from the Illinois Department of Insurance, the Illinois Comptroller and the U.S. Census Bureau.

Springfield, for example has laid off more than 40 police personnel over the last decade as pension contributions now consume the entirety of the city’s property tax dollars. Alton sold offits water treatment facility in 2018 for $54 million to help pay down the $113 million owed to its police and fire funds. Mount Prospect “fell behind on street maintenance” as it was forced to make tradeoffs between pensions and core services.

Other cities are raising taxes and fees to try and keep up with pension expenses. Du Quoin recently hiked property taxes by 15 percent to avoid layoffs. Some cities, like Danville and Peoria, have created new “pension fees,” while others, including Bloomington and Elk Grove, have added new utility taxes to try and cover the growing costs.

Miss Clipping Out Stories to Save for Later?

Click the Purchase Story button below to order a print of this story. We will print it for you on matte photo paper to keep forever.