Letter to the Editor: Why not merge 118-member House with 59-member Senate and make new body of 102?

As we move through 2025, we need to set aside the adversarial attitudes that try to pit “rural folks” versus “urban folks” — whatever the definition of “rural” and “urban” is these days.

A non-binding referendum to explore separating Cook County from the rest of Illinois (hinted at during a “New Illinois” lecture I recently heard) strikes me as an example of this “Them vs. Us” mentality. In this statement, I have tried to assess this referendum in terms of economic realities and fair government representation, not in terms of ideological differences.

It would be a good idea for voters to look for the first time or take a second look at studies prepared by Southern Illinois University Paul Simon Public Policy Institute in 2018 and 2021. Readers can also examine the rebuttal by New Illinois to the 2018 paper. Voters should form their own opinions as to the realities of redistribution of state funds. I think it will be the first time look for most people.

If there are factual statistics anyone finds to support or refute this material, now is the time to do it. The Southern Illinois reports were distributed by the Illinois Farm Bureau and Illinois Press Association.

A revised report by John Jackson and John Foster, who wrote these 2018 and 2021 reports, should be out shortly, hopefully with up-to-date data that will provide further clarifications of what I address in this offering.

My first reading of this material was based on an article in local news I read dated Aug. 29, 2021. It reported by the population the amount of tax return to a given county in Illinois based on each dollar collected. The disbursement/collection ratio showed some areas receiving as much as $2.88 in disbursements for each $1 collected. Adams County, as part of central Illinois. was said to receive $1.80 for each $1 paid. The five counties adjacent to Cook received only 60 cents for each $1 paid, while Cook County received 98 cents.

It is interesting to note that only Cook County — and specifically, the people of Chicago — is being singled out by New Illinois to be removed from the rest of the state. The other Chicago suburbs outside Cook County are even admitted by New Illinois advocates to be cash cows of state revenue supply. We must be reminded that Cook County is not just the city of Chicago but also 134 other cities and municipalities with a collective population of some 5.27 million people. Nine other northeast counties close to Cook County have a population of another 3.56 million, which collectively represents 69 percent of Illinois’ population. This can be defined as zone 4 of Illinois’ 10 economic development regions.

In 2020 and 2024 elections, more than half of a million people in Cook County alone voted for Donald Trump. While the population of Cook County is about 40 percent of Illinois, there is only about 40 percent of our General Assembly, both House & Senate represented from the county of Cook either totally or in part with other counties.

Objectively, it costs as much to build a new bridge across a river in a county with a population of 200 people in that square mile as it does in an area with 200,000 people. In either case, the revenue has to come from collective government bodies — local, state, federal or a combination thereof.

The previous SIU studies do not clarify whether corporate taxes (such as those collected by public utilities and large corporations) are counted as revenue from their customers in each location or are all lumped in a headquarters location. For example, do all taxes collected by Ameren Illinois count as revenue for their HQ location in Collinsville and Aldi HQ in Batavia? Or are the funds attributed to the location of the customers paying them?

These studies appear also to only attempt to cover taxes and not revenue generated from fees or fines, and I see no mention of gambling revenue except for the Illinois State Lottery. So, revenues such as auto and driver’s license fees, toll road fees and personal or corporate fines may very well not be included. Internet sales may also be omitted.

The 2021 report on page 31 does call out specific revenue and disbursement numbers that are not traceable to specific counties and regions, so perhaps the revenues I mention are considered in this revised document as such. The data represents the years 2013-2016, so it would be good to see more recent data.

It is also my understanding that the property taxes I pay each year in Adams County are all spent within Adams County. These funds are also not included in this report.

Now let’s compare Illinois to Missouri.

While returning from the St. Louis airport the other day, I stopped at Aldi in Hannibal to get food. I paid 5.85 percent in state and local taxes. We pay 1 percent in Quincy, and the grocery state tax is being repealed Jan. 1, 2026. Cities like Quincy have the option to still tax at 1 percent if they choose to start on that date.

All three Quincy mayoral candidates have come out in favor on the 1 percent continuation. Now the City Council of Quincy has awakened to the fact that Gov. JB Pritzker has “put upon them” the choice of taxing or not taxing themselves for non-prepared food items for 2026. Do they also recall the 1% tax being removed from July 1, 2022, until June 30, 2023? Today you will pay in Quincy $5.96 for a dozen eggs but be taxed only 1%. You can buy rotisserie chicken for $4.98 but pay 8% in tax as it is prepared food.

RMDs (Required Minimum Distributions) from 401K and IRA retirement funds are also not taxed in Illinois like they are in Missouri. I checked for grins & giggles what anyone with modest IRA savings would have paid in Missouri state taxes for 2023. Missourians pay well into the four-figure dollar range, while Illinoisans pay nothing.

Retired people need to think twice about moving out of Illinois to Missouri if they have IRA savings or buy food.

Personal property replacement taxes (PPRT) have been in the local news for Quincy’s budget recently. These are revenues collected by the state and paid to local governments to replace money that was lost by local governments when their powers to impose personal property taxes on corporations, partnerships and other business entities were taken away. This action was undertaken in the late 1970s as part of a new Illinois constitution, which established that Cook County would receive 51.6 percent of the PPRT funds while the rest of the state gets 48.4%.

Maybe it is time to recalibrate this ratio. While Cook County’s share might go down, it may very well go up.

It is worthy to note that in 2024 Adams County had an intake of more than a quarter of a billion dollars ($259M) into video “gaming.” I call it gambling. While 90 percent came back to the people paying into the machines, some 10 percent (about $25.5 million) got distributed to the companies owning and operating the machines, the merchant who had the machine at their business, and finally the state and local governments.

It is also interesting to note that the largest county in Illinois, Cook County (with roughly 10 times the population of Adams County), had just $294 million in video gambling intake. Despite the population size difference, Cook only surpassed Adams County by $35 million because video gambling is not currently legal in the city of Chicago — only in other cities in Cook County.

Unless the payout is $1,200 or more, there is no IRS 1099G document generated, so no federal taxes get paid on these video gaming earnings unless the person reports them in good faith. The IRS website tells me that all gambling earnings are taxable. It is also noted that one of the largest gaming machine manufacturers and suppliers is based downstate in Effingham. Adams County and region-elected officials embrace this revenue as a good way to hold down taxes. It is not just the Democratic governors of Illinois who have turned the state into one big casino.

I would prefer to write at my discretion an extra check to the government if I agree on what essential services are and their cost over trying to use gambling revenue at the expense of others — some of whom may have an addiction to or not the personnel budget for such expenditures. I don’t want available revenue for education dependent on some people’s gambling habits.

Video gaming and sports gambling look like they are here to stay, but let the revenue go to non-essential projects like the renovation of QU Stadium that could bring good summer family fun to the community.

The single major reason for better financial revenue in the state of Illinois occurred when the U.S. Supreme Court ruled in 2019 that all items purchased on the internet were subject to state sales tax. From at least 2010 until the 2019 ruling, the Illinois tax form IL-1040 had a line 23 to have the taxpayer record what they purchased on the internet. It said, “Do not leave blank.”

While the state collected out-of-state auto sales tax, this line about internet sales would only collect about $6 million a year from people voluntarily in good faith reporting their internet purchases. Does that mean that many people put down $0 on line 23 when in fact they made purchases on the internet tax free due to the law not being enforceable? I can’t help but think that the survival of many local brick-and-mortar businesses is due to those businesses being on even and fair playing ground with the internet sales organizations.

If someone buys dog food for their pup online, they pay the same sales tax to Illinois that they would inside a local pet store. When Covid hit in 2020, these payments went into effect, and the state continued to get needed sales tax when internet sales skyrocketed. Anyone care to guess how this would have affected the financial condition of the state if the Supreme Court hadn’t made their ruling in 2019? The exact numbers can never be defined, as retail sellers don’t need to report earnings of internet sales separate from in-store sales.

On inflation, we all complain about it and listen to 100 reasons why we have or have not had it these past four years, but the 101st reason is the $1.2 trillion in government spending just for “Paycheck Protection” and “Stimulus” checks to many businesses, organizations and all taxpayers that went out in 2020-2021.

The vast majority of this money strikes me as necessary to go out to business, organizations and families. However, when our government prints and injects this much cash into society and the amount of goods and services does not increase, economic scarcity occurs (Economics 101). Adams County was ranked ninth in per capita distribution to businesses in Illinois due in part to a very aggressive campaign by local lending financial organizations that, yes, got significant revenue from the government to administer these ultimately forgiven loans.

Stimulus Round 1, March 2020: Up to $1,200 per income tax filer and up to $500 per child

Stimulus Round 2, December 2020: Up to $600 per income tax filer and up to $600 per child

Stimulus Round 3, March 2021: Up to $1,400 per income tax filer and up to $1,400 per child

If it was not for scarcity, there would be no need for money.

If it was not for original sin, there would be no scarcity, so they say…

I have already heard every Republican elected official representing me play upon “them versus us” mentalities. It would be refreshing to hear at least one of them publicly come out in favor of a “one Illinois” policy.

Without distractions like the polarizing New Illinois proposal, we could focus on things such as regional transportation issues. Quincy needs reliable commercial air transportation, including making Quincy again a jet aircraft location like it had been in 2018-19 when our airport made its 10,000 enplanement goal numbers. If the community had stuck with SkyWest air service in 2019 (like the city of Decatur has), the city would have been awarded $1 million annually in 2024-2026 for airport improvements. Instead, we’ve received $150K in 2024.

While the community is averaging about one out of 10 people flying out of Quincy, the metro area of the Quad Cities with a population of nearly half million shows over one person out of two flying from the Moline airport each year.

Because air travel between Quincy and St. Louis has been so unreliable, it has most likely been underutilized. Even looking at those meager air-ticket sales, a reliable shuttle bus service between Quincy, Hannibal and St. Louis would likely earn about $250K in revenue each year (assuming the bus charges $50 for a one-way ticket). If people who drive to St. Louis and pay high parking fees at Lambert begin using the bus, I’d estimate revenue climbing to at least $500K. Even with good jet service out of Quincy to Chicago now looking to be possible, people going to the St. Louis airport by auto transport will remain the dominant mode of transportation in the community.

Our community’s reliable ground transportation options would be greatly enhanced if organizations like the Great River Economic Development Foundation considered sites like the former Quincy Public School bus barn. Repurposing the site would have provided a much-needed location for improving commercial bus and shuttle options for travel to and from the community.

Our elected officials should quit allowing the mobile phone providers to drive a wedge between rural and urban communities by only focusing their 5th Generation (5G) build out to high-speed mid-band and higher speed mmWave frequencies and have them also focus on blanket voice and text data coverage with low band “n71” frequencies 600-700mHz from the now vacated UHF-TV Ch 37-51 spectrum.

If a farmer wants to download movies and let his tractor run in his field by GPS with high speed 5G that is one thing, but if he can’t get a call from his sister that they need to take mother to the hospital because of poor rural coverage, that should be the first issue to be addressed. The other day I watched with disgust a Verizon commercial that characterized a rural area as someplace a 5G high speed service user would spend little time in.

In my opinion that I wrote about death, taxes and staying with Illinois on June 22, 2023, I wrote an alternative proposal of how estate taxes should be administered while our local elected officials continue to propose “dead on arrival” legislation to completely repeal it.

While Illinois had indeed lost some ground on Gross National Product (GNP) and perhaps some population due to “white flight,” it is interesting to still compare the last final GNP numbers for a full calendar year, 2022, to Illinois’ five adjacent states.

- $1,025,667,000,000 Illinois (Over one trillion)

- $470,324,000,000 Indiana

- $396,890,000,000 Missouri

- $396,209,000,000 Wisconsin

- $258,981,000,000 Kentucky

- $238,342,000,000 Iowa

If readers are still with me, I offer a proposal for meaningful change to make downstate voter representation more inclusive. If you want more effective government in Illinois, something to consider is the idea of Illinois merging the Senate and House into one elected body.

Observing the Illinois government legislative process to me is like observing two committees in a large company working on the same projects or issues that never meet collectively together. This often occurs in mergers when companies don’t effectively integrate their resources.

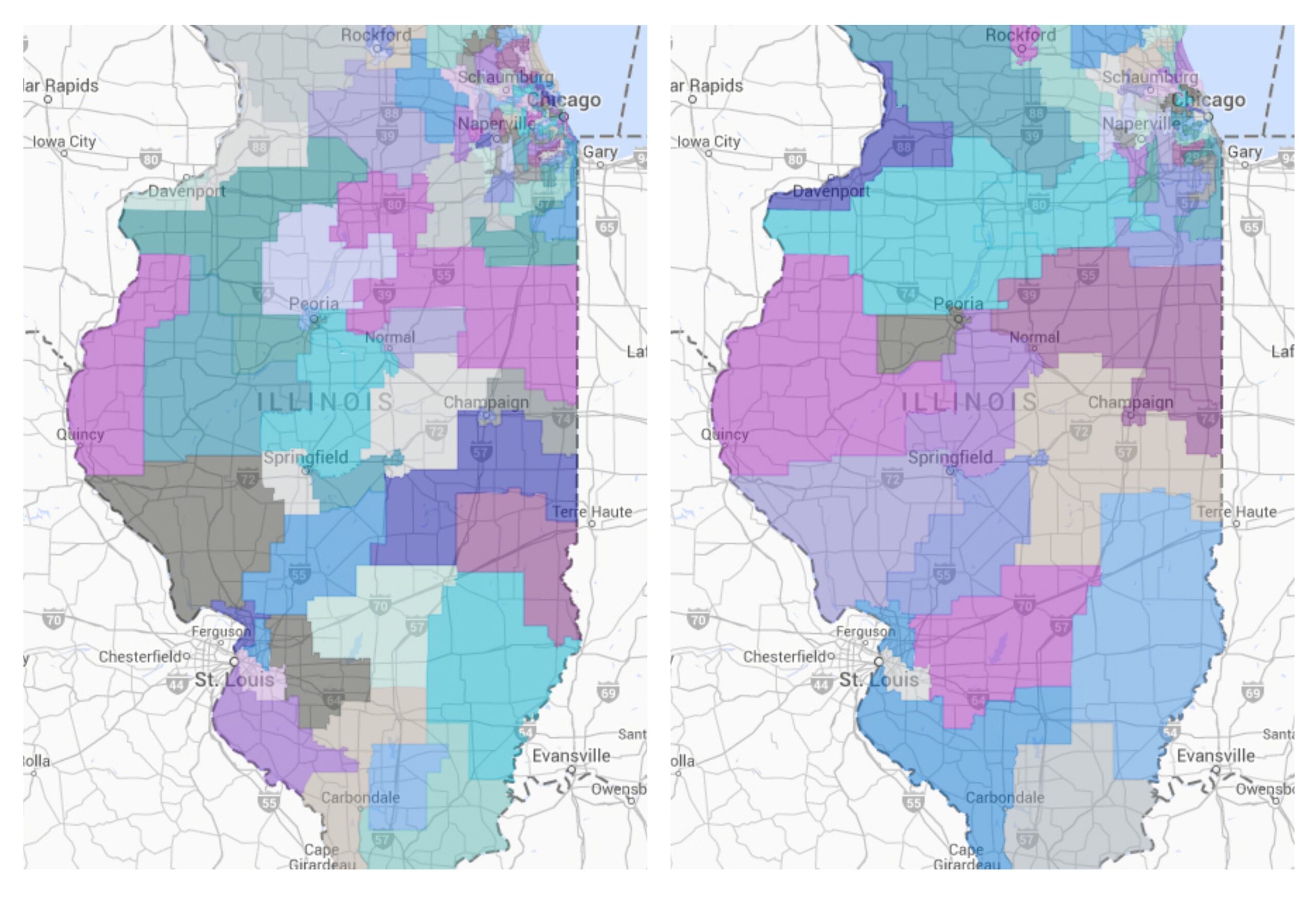

Why not take the 118-member House elected every two years (38 representing Chicago) and the 59-member Senate elected every six years (21 representing Chicago) and merge them into one body, with all members elected every 4 years? Today we have so many House members spending too much time running for office to try to survive their party’s primary than the general election in November.

Going to a four-year term would allow them the better opportunity to vote on issues they feel are in the best interest of the people they represent and the state as a whole.

Make the number of seats in this body 102, as that has been the number since the 1850s of counties we have in Illinois. From this, make 51 districts with each district having two elected representatives who would be elected on alternate four-year cycles so everyone in the state would be voting for one candidate every two years.

When drawing up districts, make it the law that no county at or under the population of 1.02% of the total population of Illinois has more than two congressional districts in that given county. This would better tie the district map boundaries to geography and less to the endless gerrymandering that goes on in our country today. The body of 102 representatives would replace the current 177-member body, significantly reducing state government. This would provide cost savings for the state, with less government and more effective results.

Under the current setup, we had the situation in our 2024 election to have three different Illinois House districts of the general assembly representing Adams County. In the new plan, the law would prevent us from having more than two districts. In all likelihood, we would only have one district for Adams County, with the possibility of counties adjacent to Adams being in the same district.

This would, of course, require a change to the Illinois Constitution and no doubt need to be sustained by the U.S. Supreme Court due to a long list of special interest challenges. I think continuing what was taking a direct copy of our federal Congressional system back in 1818 needs to be revised.

We based the current structure on the U.S. Congress. We have two houses of U.S. Congress to be fair to small states and larger states. The only practical reason to replicate this on the state level is that the Illinois House gives the people the ability to recall elected officials sooner (every two years) while the Illinois Senate (with its six-year terms) may best prevent short-term public opinion from affecting the state’s best interest.

We would still retain the ability to recall a representative every two years, but the other representative would remain in office until the next election in two years under this plan. Sure, there have been times in our state history when we have had a majority of one party in the House and the other party in the Senate, but will we ever again have that situation? And does this benefit (if it is a benefit) outweigh all the inefficiency cost? Yes, Cook County would still have about 40 percent of the seats in this new legislative body, but 40 percent is no majority.

Today only Nebraska runs its legislative body in such a “unicameral” way.

In closing, I quote a speech given by Dwight Eisenhower in October 1952 shortly before his election as president. Many think this was a time when the highest percentage of people in our country felt good about our election results … when America was great. His popularity began to decline, however, with his actions in 1954 of sending federal troops into Little Rock, Ark., to enforce federally mandated integration laws.

“So long as they are faithfully observed, the energies, courage, endurance and wisdom of the American people constitute a titanic force. Measures against it, domestic problems, disasters of nature, the pretensions of tyranny shrink to difficulties of the moment. Crises may test the uttermost, but they can never conquer the spirit of a united America.”

That said, it also follows for Illinois.

Don Carpenter

Quincy, Illinois

Miss Clipping Out Stories to Save for Later?

Click the Purchase Story button below to order a print of this story. We will print it for you on matte photo paper to keep forever.